Communication, the sharing of information, is an integral part of modern life. Access to communications at high data rates and low latencies is not yet globally assured. Several companies are hoping to service that gap by leveraging the current trends in space. This thought paper focuses on the rise of commercial low Earth orbit (LEO) communications satellites (SATCOM) – their enabling technologies and the markets they hope to service, expand, and create.

LEO SATCOM

Prime Movers Lab

March 2022

The Rise of Mega Constellations

The LEO constellation architecture for space-based telecommunications is not novel - it was originally proposed 30 yrs ago in the early 90s. That initial wave of proposed constellations included a bankruptcy (Iridium), scaled-down plans (Globalstar), and a project cancellation with the return of investor capital (Teledesic). That history left many in the satellite industry justifiably skeptical of the second wave of LEO constellations proposed by SpaceX, OneWeb, Amazon, and others. While the question of business longevity still remains to be demonstrated, there have been several advances in technology that have lowered CAPEX enough to give LEO SATCOM a fair shot on goal.

Macro Trends: Reduced Cost of Launch AND Moore’s Law

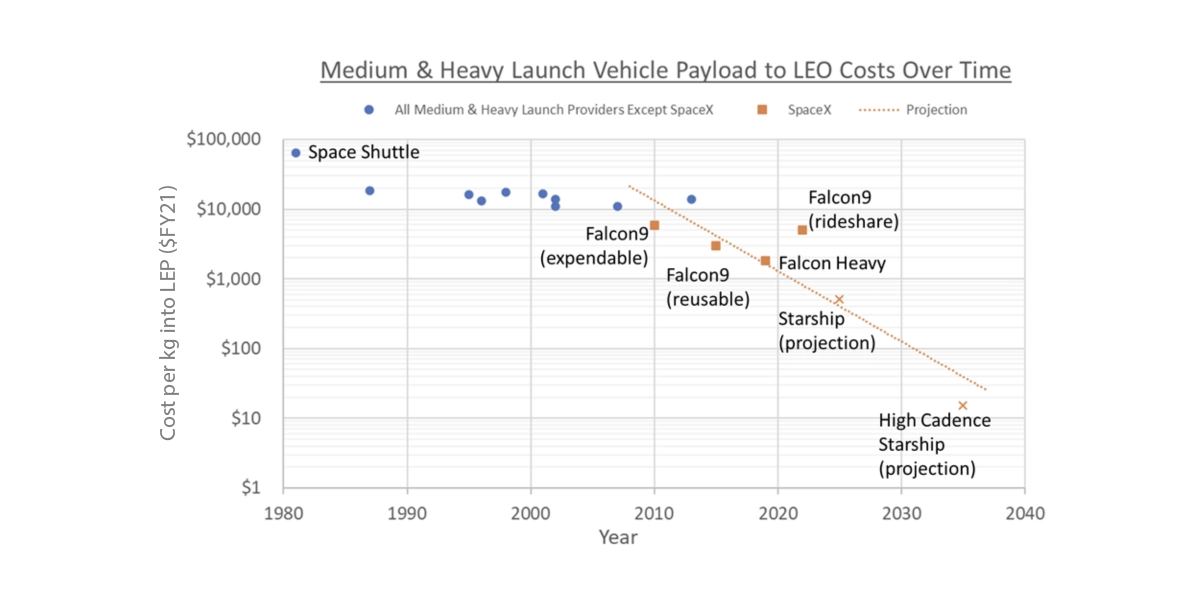

I’ve previously written about the decrease in launch cost and increase in launch cadence[1] and the coming wave of medium-lift reusable launchers from RocketLab, ISRO, China, and France.[2]

The cost of launch has dropped one order of magnitude already. Successful operation of Starship will drop it another. Over the next few years, new reusable launch vehicle designs will be coming online from RocketLab, India, China, and France.

LEO constellations require hundreds to tens of thousands of satellites – the many launches needed to deploy the full constellation are no longer untenably expensive. (Still pricey enough to be spelling billion with a ‘B’. Elon gave an initial cost estimate for Starlink of $10B, later revised to $30B. Telesat estimates $5B for their Lightspeed constellation. Those numbers include satellite manufacturing and launch.) The other macro trend working in LEO SATCOM’s favor is Moore’s Law, which has shrunk both the size and power requirement for the electronics – allowing this generation of communications satellites to be small and lightweight.

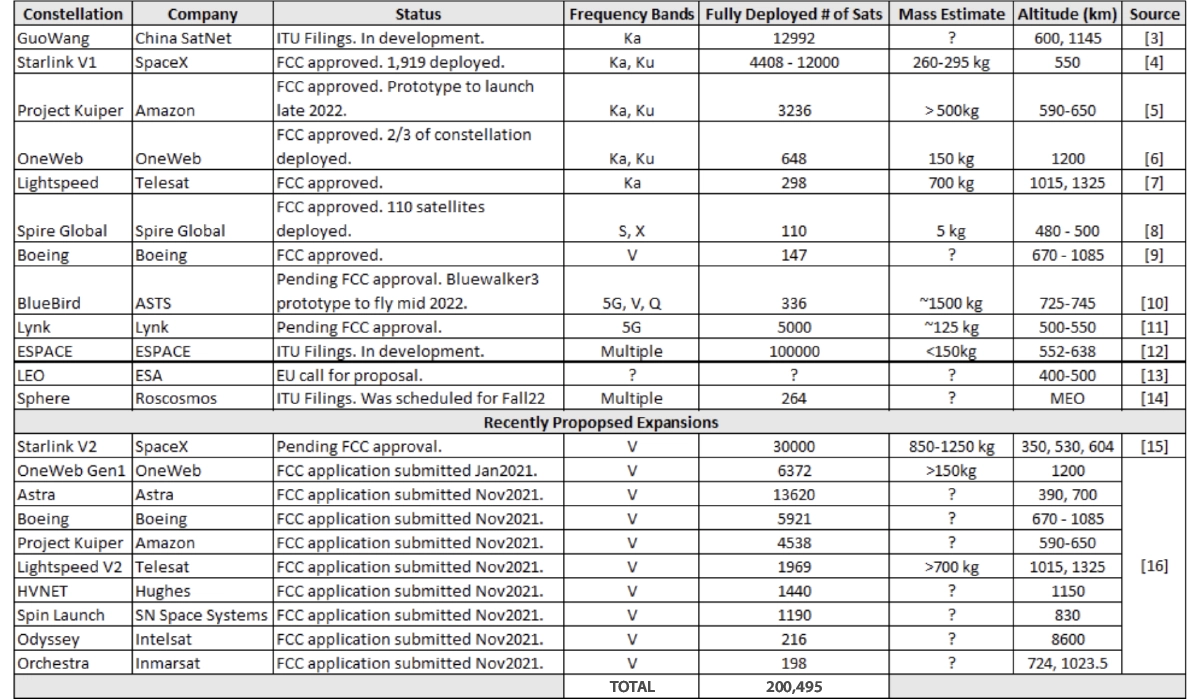

Selected ongoing and proposed commercial communications mega-constellations

If all the proposed constellations were to come to pass, that would increase the satellites on-orbit by 40x. (As of March 2022, there are ~5000 satellites in orbit). There are industry analysts who have metrics to assess the likelihood of any given constellation coming to fruition, so I won’t re-invent the wheel here. (Curious readers should check out work by Quilty Analytics,[17] NSR,[18], or space economists like Pierre Lionnet[19] for their heuristics and rankings.) Instead of focus on likelihood, let’s review ongoing results. Starlink has deployed nearly half of the original planned 4408 constellation, OneWeb has deployed 2/3 of their original constellation (but unfortunately lost their ride due to Roscosmos refusing to supply Soyuz launch vehicles during Russia’s ongoing war with Ukraine), and Project Kuiper has secured nine of ULA’s Atlas V rockets for their first phase of deployment (likely to start in 2023). Telesat has secured financing for their constellation and selected a supplier. For a detailed analysis of the performance of these four constellations, please see notes[20].

The table does not consider any growth in Internet of Things (IoT) constellations, Earth Observation constellations, weather, positioning/navigation, in-space compute, or in-space manufacturing. For a running list of the hundreds of proposed constellations, www.newspace.im is a great resource. A natural question seeing this exponential growth in the number of satellites might be, “What’s the upper limit of Earth’s orbital real estate?” A recent op-ed in SpaceNews by MIT researchers provided an order-of-magnitude answer;[21] they share that, “individual shells can fit hundreds of thousands of satellites” and “it is fundamentally feasible for multiple operators to occupy slots in a shared shell.” This serves as today’s reminder that space is big!

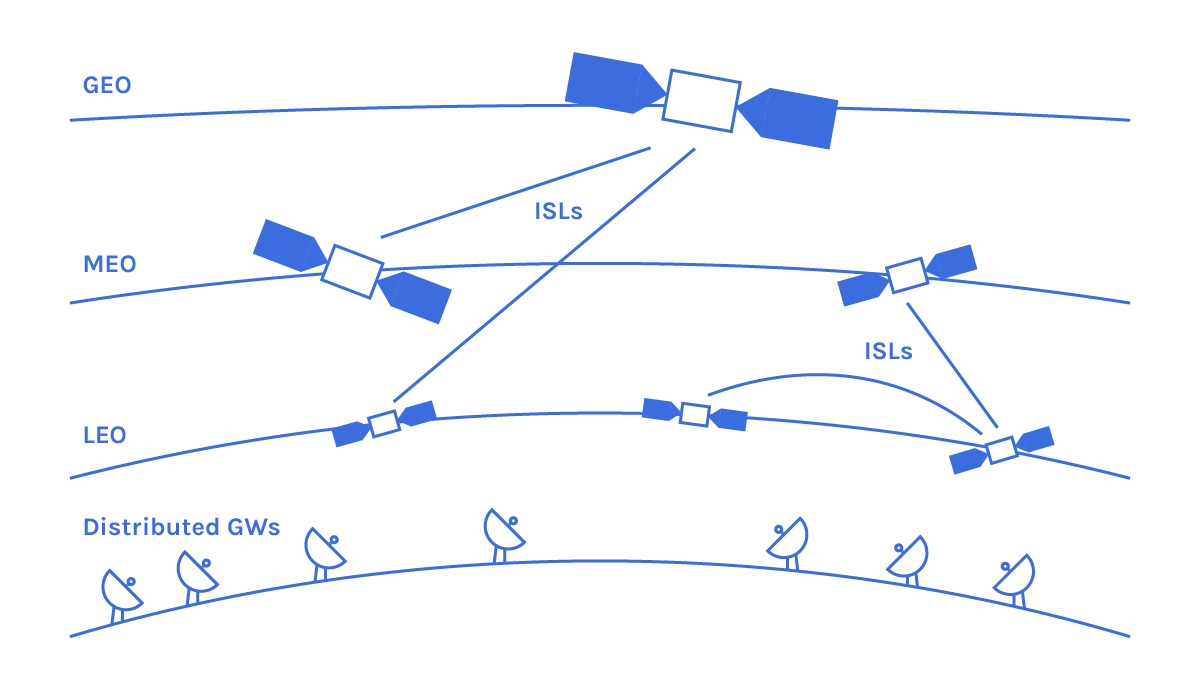

Multi-Orbit Mixed Altitude Architectures

LEO mega-constellations are not the only way to deliver low latency for customers. Thanks to inter-satellite links, legacy SATCOM companies are working on solutions to leverage their existing assets in geosynchronous orbit (GEO) and medium earth orbit (MEO). For example, SES is currently operating a hybrid MEO – GEO architecture and may one day include LEO.[22] These multi-orbit architectures will see growth in the mobile segment of the SATCOM market.[23] Note, mobile in this instance does not refer to cell phones, but rather to things like airplane wi-fi and maritime connectivity – moving platforms that can fit a receiver terminal.

Multi-orbit mixed altitude SATCOM architectures are enabled by intersatellite links (ISLs)[24]

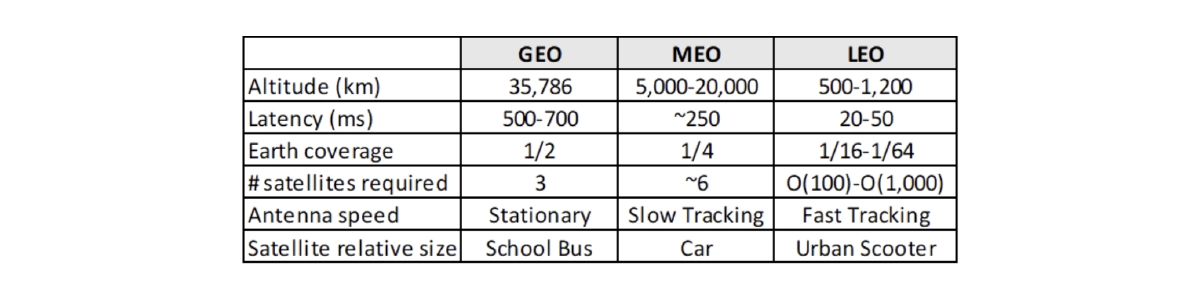

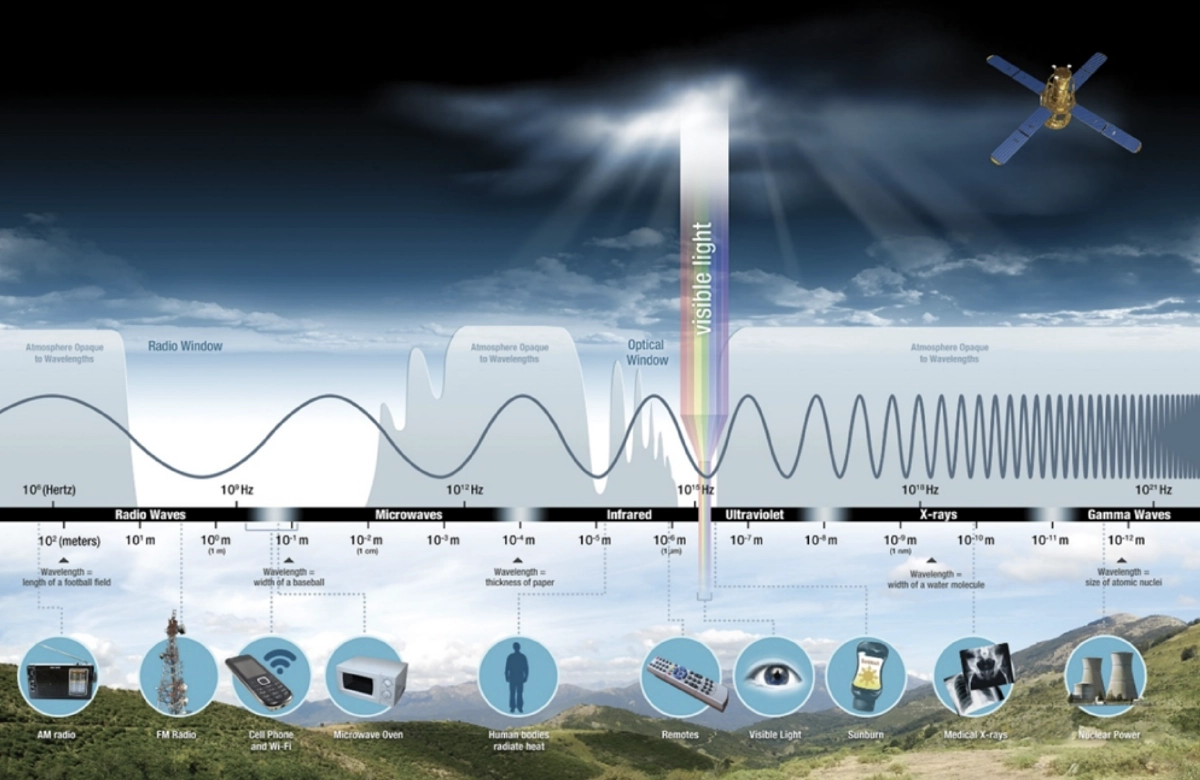

A comparison of the different SATCOM architectural features can be found in the below table. What’s not shown in the table are power requirements and the number of ground stations. The former is omitted because power is not only a function of distance for a signal to travel, but also the signal frequency. (Higher frequencies need more power to travel the same distance. Higher frequencies also have a higher data throughput. See Appendix for a NASA infographic on frequencies in the electromagnetic spectrum.) The latter is omitted because inter-satellite links are changing the paradigm for ground stations. The ability to transmit across a constellation should enable a reduced number of ground stations for LEO mega-constellations.

Features of SATCOM architectures

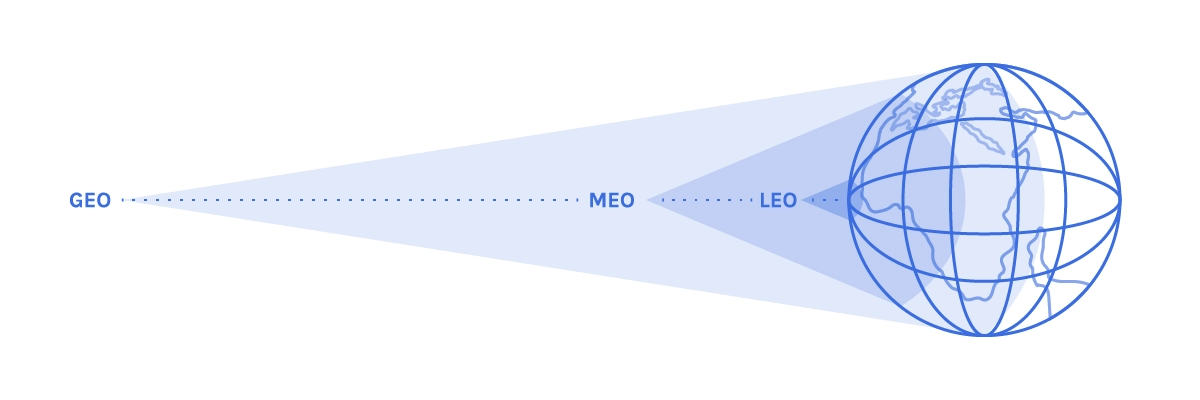

For those who enjoy mathematical derivations, see notes[25] for the equations used to determine Earth surface area projections for LEO communications satellites. The below figure graphically illustrates Earth coverage from a given orbital plane.

Relative orbital altitude and Earth coverage for GEO, MEO, and LEO[26]

The macro trends of cheaper launch cost and Moore’s Law aren’t the only drivers of the LEO mega constellation wave. The next section covers the key technologies that enabled effective small communications satellites with increased reliability and slim form factors.

Enabling Technologies

Bulky dishes and chemical propulsion are passé. Today’s generation of communication satellites are taking advantage of the commercialization of phased array antenna technology, electric propulsion, and inter-satellite links (both radiofrequency and optical).

Phased Array Antennas

Phased arrays are yet another example of technology that came out of defense research spending that has become an integral part of our everyday lives. (If you are using WiFi or 5G to read this paper, a phased array is how you’re getting your internet signal.) In 2014 DARPA had a $100M program focused on rapidly developing phased array antenna technologies.[27]

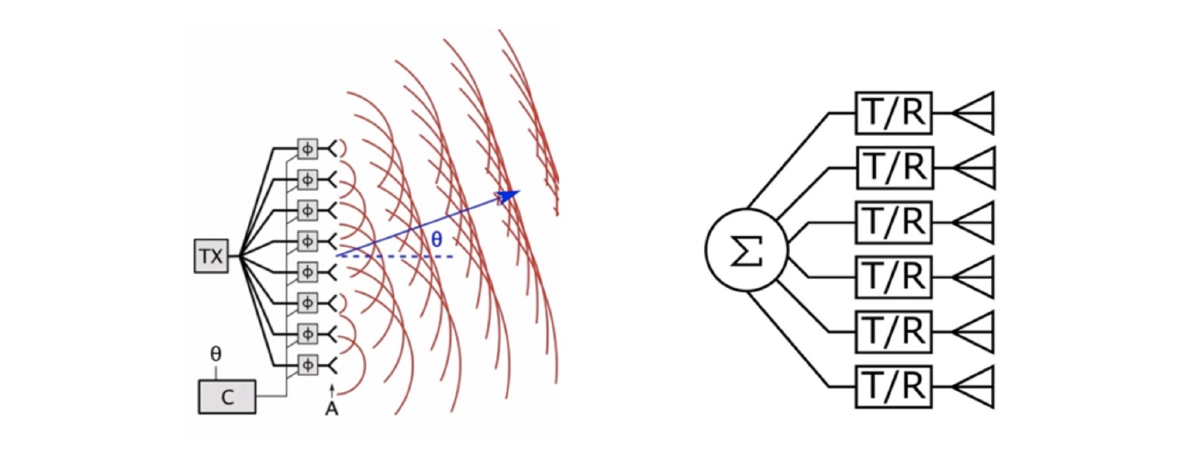

Phased array antennas include multiple emitters in a linear or planar configuration and use the principle of phase-dependent superposition to direct the signal beam without any moving parts. This is called “electronic steering” of the beam, as illustrated on the left-side of the below figure.

Left: Passive Electronically Steered Array (PESA). Right: Active Electronically Steered Array (AESA).[28]

The earliest generation of the technology was the passive electronically steered array, which used a single transmitter for all the antenna elements. Each antenna element has a phase shifter that times the signal pulse as required to regulate the composite antenna beam. Second-generation phased array antennas use active electronic steering: there are transmitters for each antenna element, and all of them are computer controlled. This enables AESAs to transmit several radio waves of varying signal frequencies simultaneously in different directions. Texas startup CesiumAstro recently completed a $60M Series B financing round for their modular AESA platform.[29]

A phased array antenna enables beamforming by adjusting the phase difference between the driving signal sent to each emitter in the array. This means that beamforming along a specific direction is an interference effect between omnidirectional emitters.

Digital Beam Forming (DBF) based phased arrays have digital receivers connected to each antenna element. As the signal is digitized at each of the antenna elements by the receivers, antenna beams can be formed digitally in a Field Programmable Gate Array (FPGA). DBF can handle multiple input data streams and generate multiple beams simultaneously from one array. This happens on the same frequency channel, optimizing efficient use of spectrum.

The pros for phased arrays include amplifying the power of the signal, beam forming, electronic beam steering, multi-beams, reduced weight, and improved reliability. The systems are more complex and have a higher burden for signal processing, but they enable much greater flexibility and capability. The improved capabilities and slimmer form factor are why the phased array antenna (sometimes called flat panel antenna) market is projected to have a CAGR of ~41 percent from 2021-2026.[30]

Electric Propulsion

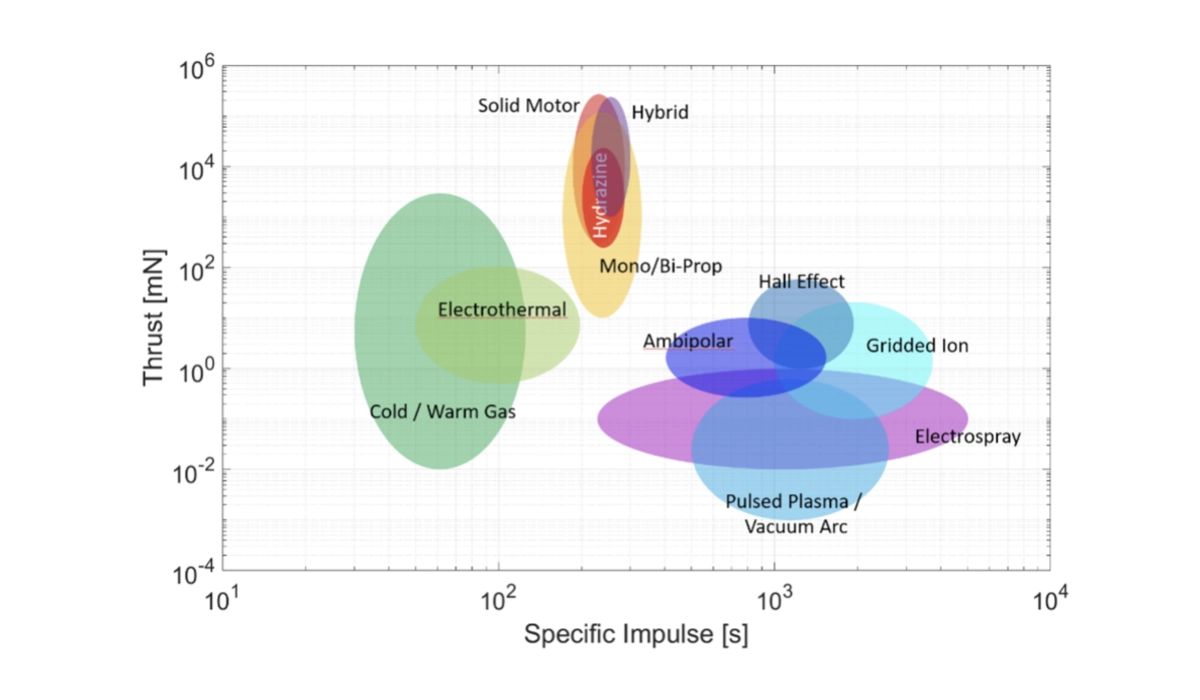

In-space propulsion has a sizeable design space, as illustrated below, with a half dozen different options available to complete the standard tasks of a satellites’ mission life, such as station keeping, maneuvering to avoid debris, and end-of-life retirement moves (deorbit for LEO or park in graveyard orbit about GEO).

In-space propulsion design trade space[31]

Large school bus-sized GEO satellites typically use monopropellant hydrazine thrusters for their propulsion system; hydrazine is easily storable for long durations and doesn’t require an igniter. Simplicity and reliability – things all engineers love in a design. Standard hydrazine thrusters provide a fuel efficiency (Isp) on the order of 200s and thrust that scales with size/pressure, anywhere from order 1 to 100 Newtons of force. The concept of operations for in-space chemical thrusters is generally shorter duration hot-fires to provide a quick impulse. School bus-sized satellites have room for things like propellant tanks, which were larger since GEO satellites typically operate for a 15-year mission life.

LEO satellites have different mission needs and so have been leveraging the advances in electric propulsion for their designs. Depending on the orbital altitude selected, LEO satellites can have a mission as short as five years – naturally deorbiting due to orbital decay from atmospheric drag. Most LEO constellation operators put an upper limit on their satellite life of 10 years (the current guideline for orbital debris mitigation is to deorbit satellites before 25 years). The shorter mission life is selected for LEO because it’s more advantageous to constantly refresh the constellation with the latest technology. LEO mega-constellations are driving an industry trend of satellite disposability.

Shorter mission life coupled with a desire for smaller satellites led the cubesat community towards electric propulsion. As mentioned previously, the evolving design paradigm for LEO SATCOM is slim profile. This helps with the volumetric efficiency of the payload during launch, as well as reducing the cross-sectional area in the direction of the velocity vector (which reduces drag and, therefore, the amount of station-keeping needed). Electric propulsion thrusters are exceptionally fuel efficient, with Isp ~ 1,000s, so the amount of fuel (typically a noble gas) needed is tiny. Electric propulsion is an enabling technology for the slim design paradigm. The downside of electric propulsion is the thrust is tiny, measured in microNewtons. Electric thrusters will fire for long durations, periodically turning off to deal with thermal heat soak, and can take many months to get a satellite to its final orbit.

Due to the low thrust of electric propulsors, the thrusters begin firing days before predicted conjunction for satellites to maneuver out of the way of orbital debris. Orbion Space Technology was recently awarded a Phase II SBIR from AFWERX to develop a solution for little-to-no-warning debris collision avoidance maneuvers, blending their Hall thruster with an emergency store of cold gas to increase the thrust.[32]

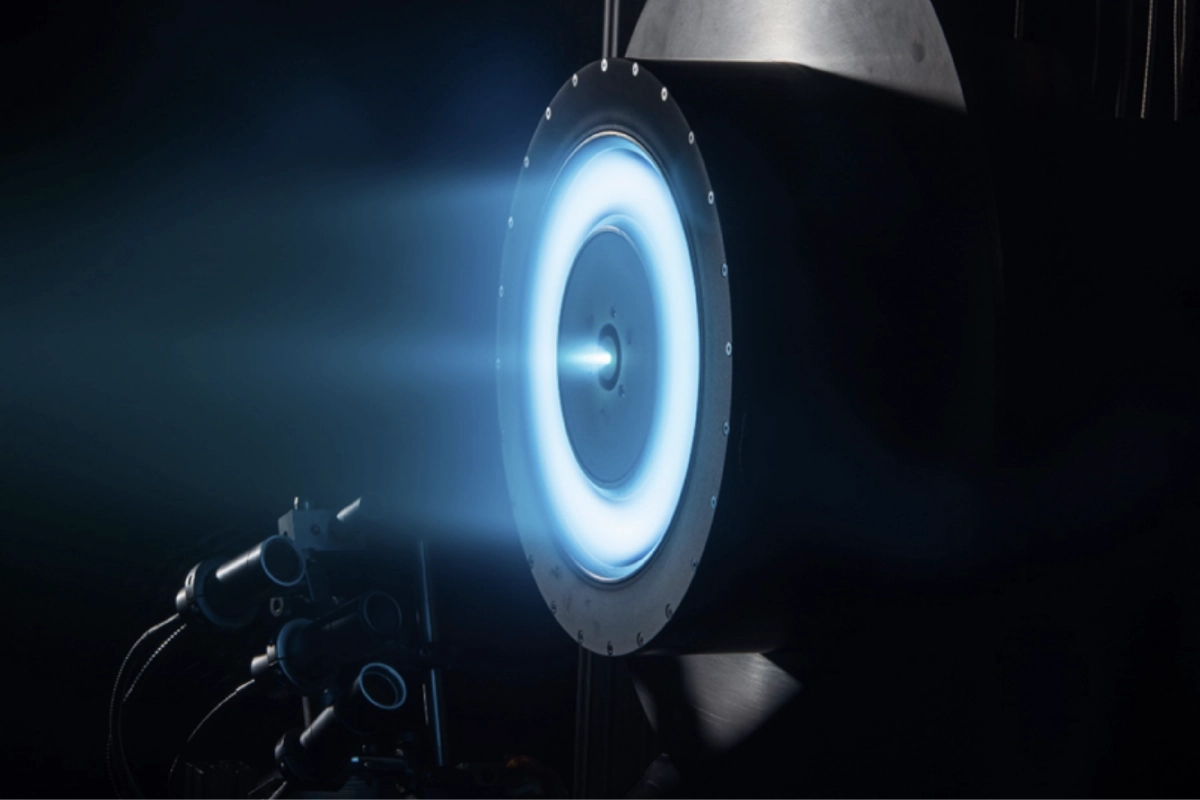

NASA’s SEP hall thruster[33]

For brevity sake, I won’t cover technical details on the half dozen different types of electric thrusters. For those who are curious about the most ubiquitous form factor, the Hall Thruster, check out this IEEE Spectrum piece for history on the inventor and explanation of the invention.[34]

Some notable deals in the electric propulsion space happened in July of 2021 – Astra acquired Apollo Fusion for $75M,[35] and Accion Systems raised a $42M Series C round on an $83M post-money valuation.[36] The global space propulsion market is projected to have a CAGR of ~16 percent from 2020-2025.[37]

Inter-Satellite Links

Enabling satellites to communicate directly with one another and to pass on information is the other major enabling technology for the success of LEO SATCOM. The industry has been primarily focused on developing and demonstrating optical-inter-satellite links (OISL) due to the very high (10x or more) data rates compared to RF. OISLs use a narrow beam of light to communicate and require a direct line of sight to minimize interference. This makes OISLs robust against jamming and eavesdropping (a bad actor would have to intercept along the line of sight path directly).

Optical Intersatellite Links – space is the ideal environment for laser-based communications[38]

The DOD and NASA have programs testing inter-satellite links, such as DARPA’s BlackJack program[39] and NASA’s Laser Communications Data Relay program.[40] There have been setbacks, such as General Atomics' recent failure to demo their OISL hardware for the Space Development Agency (SDA).[41] The SDA utilizes a more modern ‘portfolio approach’ to capabilities development, which means they have another shot-on-goal via an award to optical communications startups BridgeComm and Space Micro, who are developing an optical one-to-many links that can do point-to-multipoint transmission.[42] The commercial satellite industry’s need for optical inter-satellite links accelerated the development and adoption timelines. Several commercial OISL providers have successfully demonstrated their technology, including Tesat-Spacecom[43] and Mynaric.[44]

Ground Equipment

The big news in ground equipment has been the ability to demonstrate communications with satellites in different orbits. Isotropic Systems recently completed an additional demonstration of this capability for the U.S. Army,[46] after having done its own tests in collaboration with SES last November. One take-away from interviews I’ve conducted with officials in the SDA and Space Force is that the DOD is overrun with terminals for the various satellite systems. Whoever figures out how to make “one terminal to rule them all” will have more gold than Smaug.

Kymeta is another company working on multi-orbit terminals. Prime Movers Lab Technical Partner Alessandro Levi did a fantastic job explaining their technology in his whitepaper on Metamaterials,[48] so I’d rather direct curious readers there. (Kymeta also has a whitepaper on their website for even more technical readers.[49]) Kymeta is working on a stationary user terminal for OneWeb’s network, to be released this summer.[50] In February, Kymeta entered into a strategic partnership with Kratos to develop a mobile antenna and software-defined terminal solution.[51]

Commercial Satellite Market

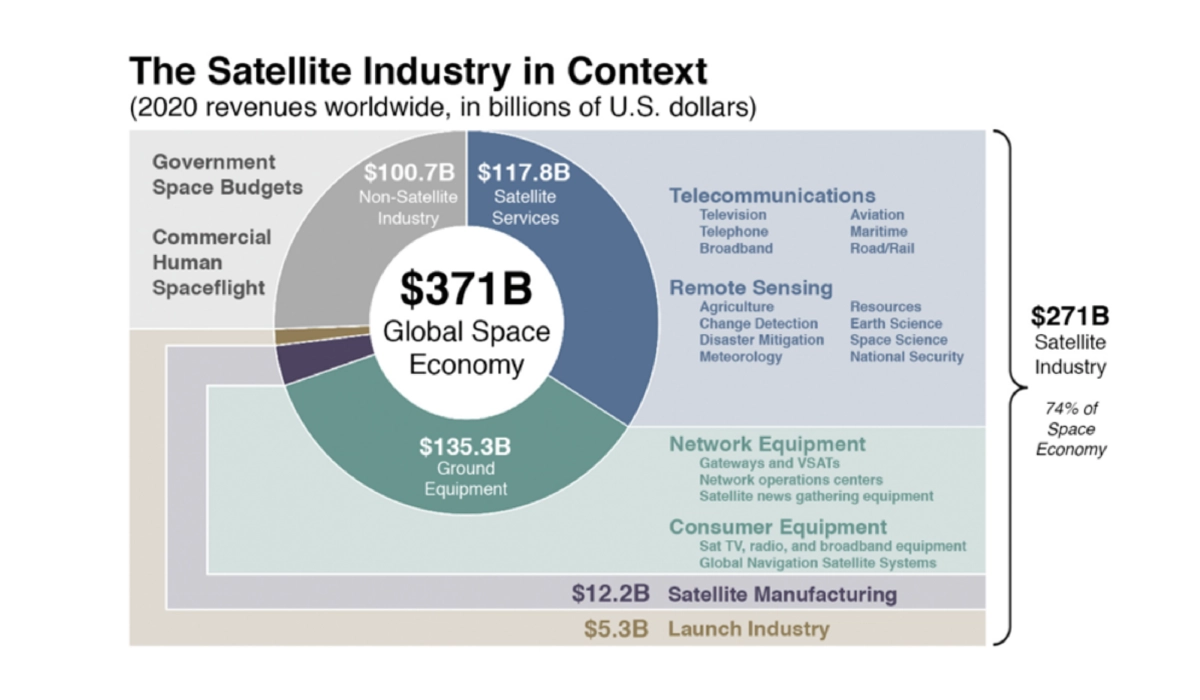

The satellite industry clocks in at $271B as of 2020.[52] The SATCOM portion of that market is currently ~$22B (minus the part of the telecommunications market that is focused on television and radio).

Satellite Industry Association (SIA) and BryceTech 2021 report “State of the Satellite Industry”[52]

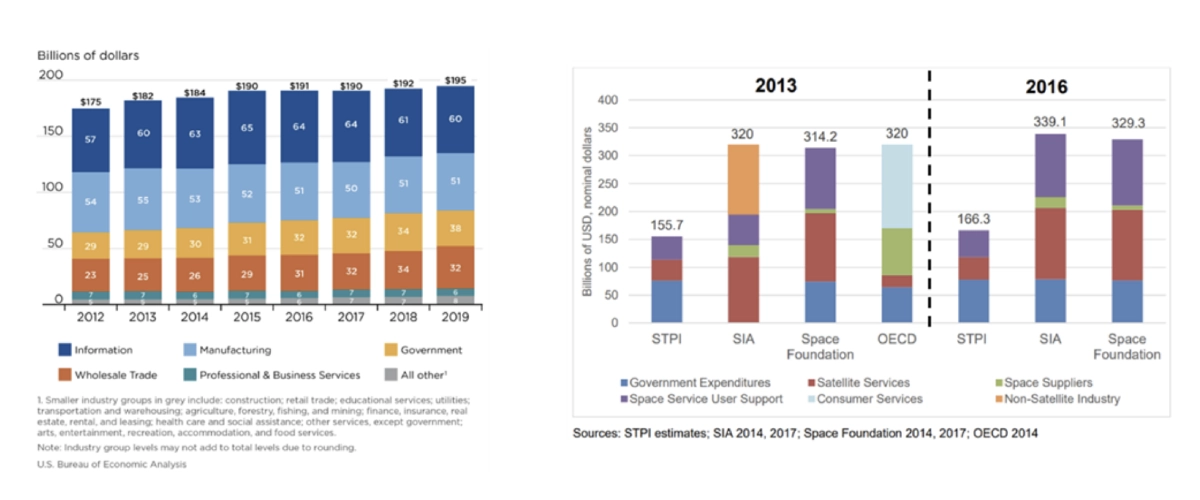

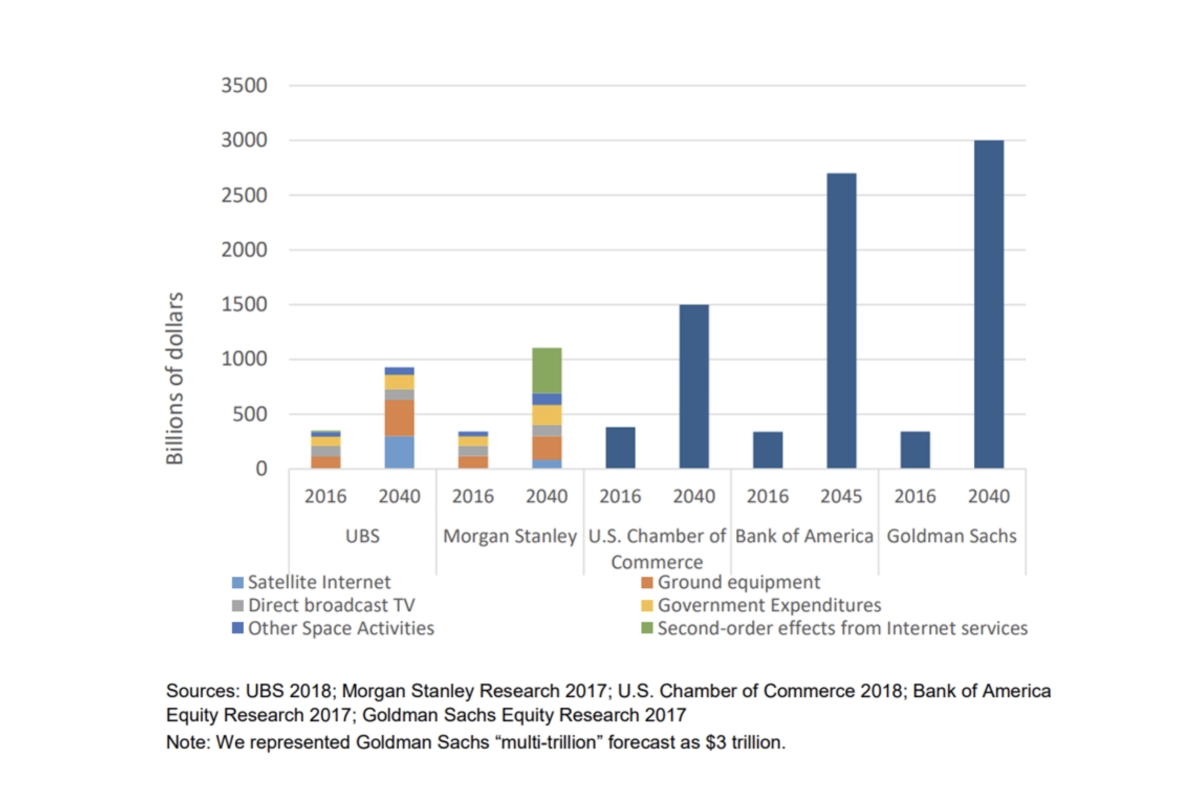

For context, terrestrial telecommunications is a trillion-dollar industry. People are pursuing LEO SATCOM not because of the current market size but because of the future projections (e.g. Morgan Stanley predicts satellite internet will grow to ~40 percent of the space economy, $412B, by 2040.[53]) There have been several space industry market reports done by investment banks like Morgan Stanley, Goldman Sachs, and Bank of America that size the 2040 space economy at over $1T. To be thorough, I’d like to share two more conservative analyses of the space industry so that informed readers can decide for themselves. First, the U.S. Bureau of Economic Analysis (BEA) released an analysis in January 2022 that reviewed data for the space industry from 2012-2019.[54] Second, Bhavya Lal, current Associate Administrator for Technology, Policy, and Strategy at NASA, led a study in 2019 while at the IDA Science & Technology Policy Institute to “Measure the Space Economy”.[55]

Left: U.S. space economy gross output by industry group,[54] Right: Estimates of size & composition of space economy[55]

Of note, the SIA report is for the global space economy, while the two other charts are specific to the United States. (The SIA report does provide one example breakdown by region, for the $12.2B satellite manufacturing category. The U.S. portion of that market is $7.9B.) It’s also worth noting that the SIA estimate is considered a high-quality data source! And yet there are substantial differences in estimates for the size of today’s space economy. This was shared to put into context the future projections for the space economy generated via investment bank research.

Comparisons by category of 2016 estimates and 2040 projections of the size of the space economy[55]

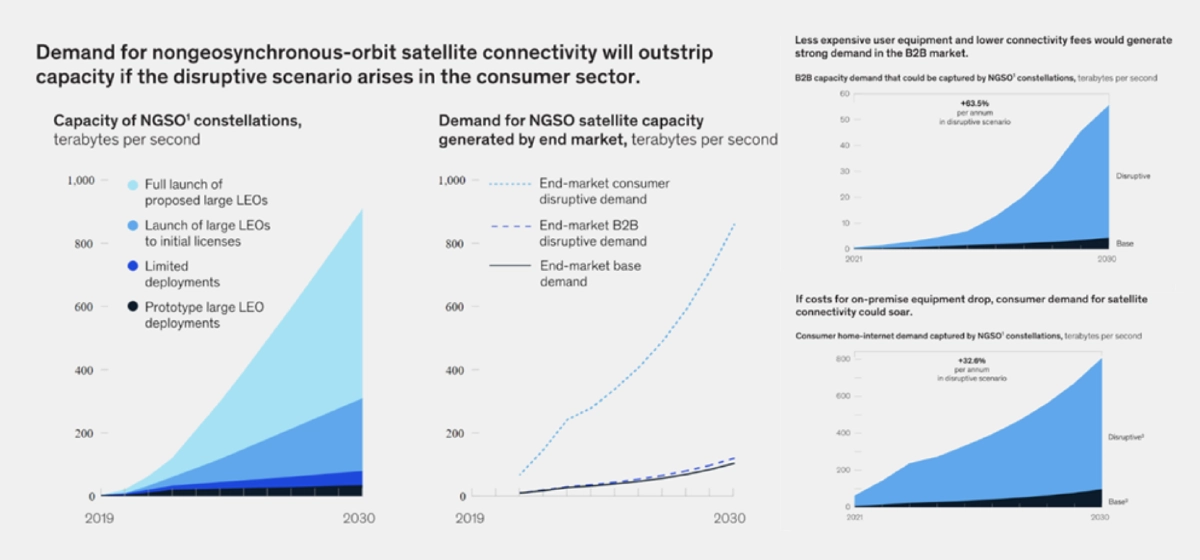

For one final perspective that’s neither government, nor space consultant, nor banker, McKinsey published a report on LEO mega-constellations[56] that models a “disruptive scenario” where costs drop enough to spur high demand. As shown in the figure below, at full deployment and with lowered home equipment costs, the consumer home broadband internet could grow by ~32 percent annually.

McKinsey report on LEO mega-constellations – a “disruptive” scenario was modeled, whereby LEO SATCOM quality of service reaches its full potential AND costs drop. The demand for satellite broadband then grows ~32% for consumers and ~63% for business[56].

Market Stratification

The SATCOM market can be stratified into the following segments: Fixed Broadband, Mobile (air, maritime, auto), IoT, 5G Backhaul, and Orbital Data Relays.

Fixed Broadband

Fixed broadband refers to satellites beaming the internet to your home/office. The competitors in this portion of the market include Starlink, OneWeb, Project Kuiper and all the other companies listed in the first table of this thought paper. There have been various opinions on growth rate and total number of customers for this market segment. Credit Suisse recent report sized the annual revenue opportunity at $9.3B, with $4.7B coming from the U.S. and Europe.[57]

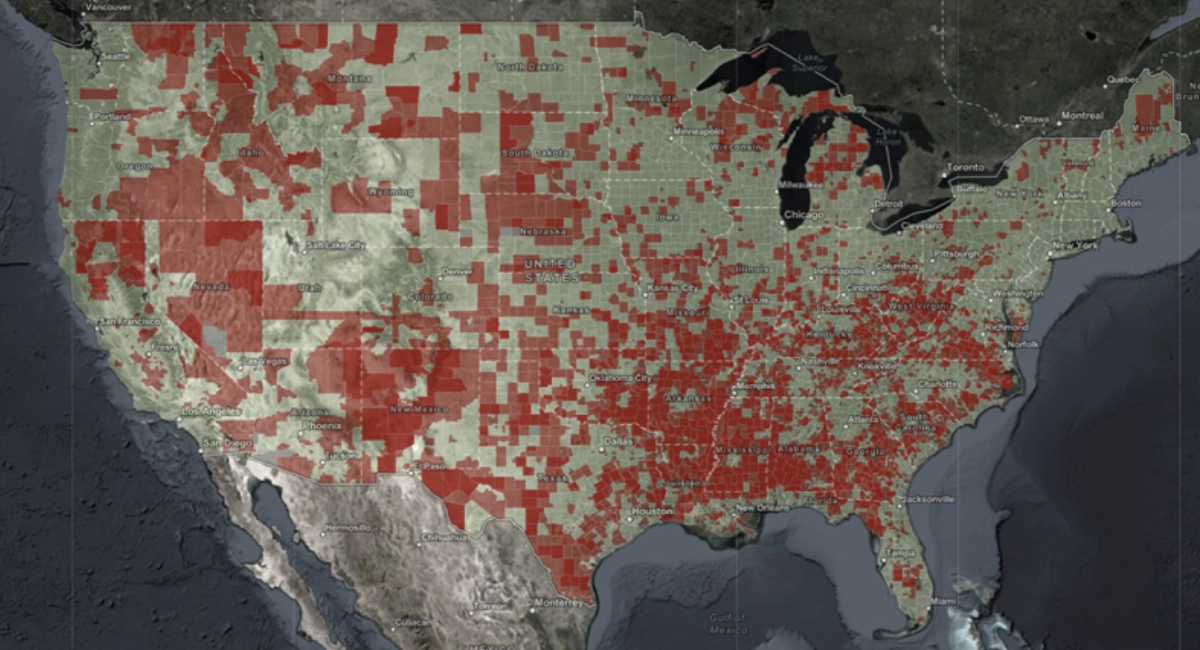

I am optimistic for this market, if only because there are so many parts of the country without good internet and the GEO satellite providers don’t have a product that can support collaborative remote work that requires virtual meetings. GEO providers’ latency is 10x that of LEO satellites- a recipe for frustration. For a detailed performance comparison of Starlink versus GEO SATCOM providers see notes.[59] (Tangentially related, I was a fan of Katherine Boyle’s recent piece, “Can Starlink Save the American Mother?”[60].)

Red zones are places where over 25% of the population reports no internet access![61]

Mobile Broadband

Mobile broadband refers to satellites beaming the internet to large things that move, like airplanes and ships. This segment was mentioned earlier in the thought paper, with respect to legacy SATCOM companies and new multi-orbit constellation architectures. The mobile market is a lucrative one, and one where customers would love to see improvement. (Imagine airplane wifi that doesn’t suck!) LEO SATCOM providers are also looking to enter this space, as evidenced by OneWeb who planned to demonstrate a second-generation beam hopping design this year and is working with startup SatixFy on an airplane terminal that supports beam hopping and is compatible with both OneWeb’s LEO satellite and GEO providers.[62] In March 2022, SatixFy announced their intention to SPAC at a $239M valuation, including a $29M PIPE.[63] The aeronautical market growth is projected to be between 8-11 percent,[64] while the maritime market is segmented with expected to grow between 1.8-2.4 percent.[65]

5G Backhaul – Intriguing New Players

Earlier we learned that the universal terminal is the dream. Instead of working on a new terminal design, what if the existing antennas in everyone’s pocket worked? Two startups are working on satellites that can communicate directly with cell phones: Lynk and Reddit darling AST SpaceMobile (NASDAQ ticker $ASTS).[10] SATCOM is a physics-bounded process. In order to communicate, something has to be “strong”- either the signal generator (really large antenna aka an enormous satellite) or the receiver (think of those giant dishes to pick up faint signals from deep space). Since our cell phones are small, the ASTS Bluebird satellites will be enormous. They are proposing 18mx20m planar phased array satellites that weigh over 1500 kg. (For a counterfactual argument to the Reddit lovefest, see notes.[66]) Lynk claims to be able to provide service in a much smaller form factor, and recently had a successful demonstration with their gen5 satellite design connecting to thousands of cell phones.[67]

5G backhaul refers to the connection from the core network station to the cell tower radio station. Satellites would provide the backhaul service in rural areas where telecom providers have not run wire connections. I’ve decided to slot the business model for both these companies under “5G backhaul,” as both have announced partnerships with cellular service providers. (And both would cover the function of backhaul and radio broadcast, saving telecom providers even more infrastructure investment dollars.) ASTS is partnering with Vodafone,[68] while Lynk is teaming first with island nation mobile network operators.[69]

Of interest, the FCC has established a “5G Fund for Rural America” that includes up to $9B to bring mobile broadband to rural communities.[70] Both ASTS and Lynk are awaiting FCC approval; if their satellites work as advertised, they could also be eligible for large non-dilutive funding awards. (For example, SpaceX was awarded $885M in non-dilutive funds for Starlink through the FCC’s Rural Digital Opportunity Fund.[71]) Both ASTS and Lynk will have to watch out for Apple drinking their milkshake. Apple is working with Globalstar, who subcontracted out the satellite design to RocketLab,[72] for what is rumored to initially be a global text messaging service with potential for more if things progress well.

IoT

One could make just as large a table for proposed IoT constellations as I did earlier for broadband. The market here is nascent, sitting around $1B in size today per notes.[73] Autonomous cars have the potential to drive a much larger market size than currently predicted. Other applications include industrial equipment monitoring, pipelines, and cargo. To narrow down the competitive landscape here, I again chose to focus on companies with satellites in orbit. Companies to consider tracking include Swarm (what will SpaceX do with the acquired IP from their undisclosed size deal?[74]), startup Fleet Space (who closed a $26M round last year[75] and received a $20M grant from the Australian government,[76]) and Astrocast (who IPO’d on the Euronext Growth Oslo exchange last August.[77]) It’s also worth noting legacy players Orbcomm, Iridium, and Globalstar all have systems that service the IoT market. In fact, Iridium’s recent positive earnings was mostly attributed to IoT growth – “Iridium’s commercial IoT subscribers grew 24% from the year-ago period to 1,193,000 customers, driven by continued strength in consumer personal communications devices. IoT Data subscribers now represent 76% of billable commercial subscribers.”[78]

Orbital Data Relays

Orbital data relays were once the domain of governments. The earliest example is NASA’s Tracking and Data Relay Satellite System,[79] born in the 1980s, and the latest example is SDA’s Tranche 1 “Transport Layer” award in February 2022.[80] One benefit of orbital data relays is that constellation operators can near instantaneously task their space-based assets (instead of waiting for the satellite to pass over a ground station). The European Union has recently deployed their own optical GEO data relay system, linking with the ISS and other EU assets.[81] Toronto startup Kepler Communications, who raised a $60M round last year, is creating what they term an in-space internet infrastructure.[82]

The other benefit of orbital relays is extracting more value from Earth Observation (EO) data. The majority of the data collected on orbit is not transmitted to the ground- this results in a lag between when information can be updated (the ~10mins the satellite passes over a ground station) versus when it can be captured (on any given orbital revolution). This problem was thrown into stark relief in early 2022 with the war in Ukraine. The open intelligence community on Twitter was relying on days-old data from EO providers to make their threat assessments. At SmallSat Symposium in February 2022, the concept of timeliness of data was repeatedly brought up in panel discussions. One startup working to alleviate this problem is SpaceLink, who are creating a MEO constellation with optical intersatellite links.[83] They plan to provide customers a way to aggregate more of their data and get it downlinked, to enable near real-time data collection. Another startup, Mangata Networks, is looking to build a MEO - HEO satellite communications network and combine it with their terrestrial data processing.[84]

Regulatory Environment

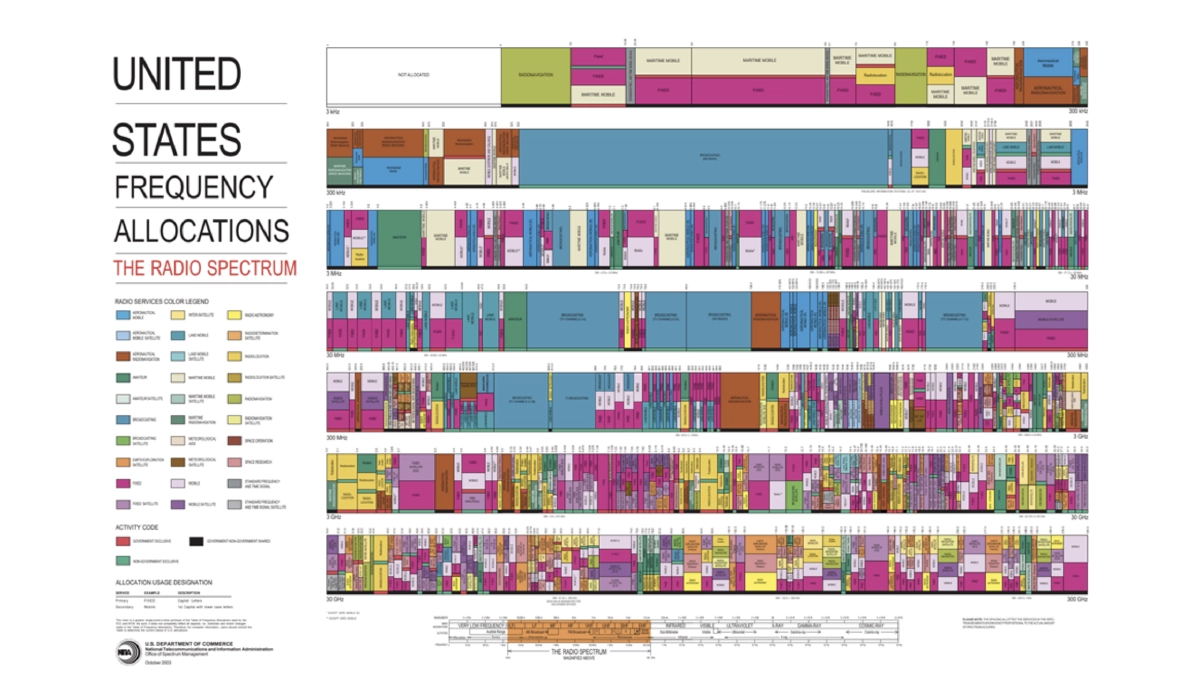

Spectrum is an incredibly valuable finite resource. In the United States, the Federal Communications Commission (FCC) holds auctions for specific frequencies, typically netting tens of billions of dollars each time. The tricky part about spectrum allocations in the U.S. is that it’s not only frequency dependent, but also local area dependent. (For example, a company can be licensed in one county of a state but not others.) The below chart illustrates the U.S. frequency allocations.

U.S. radio wave spectrum is administered by the FCC[89]

The process for getting an FCC license can take a minimum of 30 days for initial feedback up to years. Today no application gets through without some opposition. After the FCC approves the license, they get the corresponding orbital real estate slots from the International Telecommunications Union (ITU). Once a company is approved, there is a 10-year build-out requirement, and the company must show progress along the way. This is done to prevent “spectrum squatting”. For example, the Boeing broadband constellation that was approved and Boeing submitted an appeal to not have to show 50 percent of their constellation deployed by a specific date. The FCC denied their request.

The U.S. has a spectrum crunch, thanks to the large allocations set aside for the DOD and emergency services.

Companies to Track

SpaceX (Private)

Products: Starlink broadband constellation

Valuation: $100B, Last Financing: $755M, Oct 2021

AST SpaceMobile (Public)

Products: Direct-to-cell-phone SATCOM

Valuation: $1.2B (market cap), Last Financing: $462M SPAC, April 2021

E-Space (Private)

Products: Constellation as a service

Valuation: Undisclosed, Last Financing: $50M, Feb 2022

Fleet Space (Private)

Products: IoT constellation

Valuation: $128M (post), Last Financing: $26M, Nov 2021

Astrocast (Public)

Products: IoT constellation

Valuation: $729M (market cap), Last Financing: IPO on Euronext Growth Oslo, Aug 2021

Accion Systems (Private)

Products: Electric propulsion

Valuation: $83M (post), Last Financing: $42M, July 2021

Orbion Space Technology (Private)

Products: Electric propulsion

Valuation: $112M (post), Last Financing: $20M, Oct 2021

CesiumAstro (Private)

Products: AESA phased array antennas

Valuation: $400M (post), Last Financing: $60M, March 2022

Isotropic Systems (Private)

Products: Multi-orbit phased array ground terminals

Valuation: $152M (post), Last Financing: $62M, Sep 2021

Kymeta (Private)

Products: metamaterial ground terminals

Valuation: Undisclosed, Last Financing: $84M, March 2022

SatixFy (Soon to be public)

Products: Low-cost multi-orbit terminals

Valuation: $321M, Last Financing: $230M SPAC, March 2022

Tesat-Spacecom (Acquired)

Products: Optical intersatellite links

Valuation: $87M, Last Financing: Airbus M&A, Aug 2001

Mynaric (Public)

Products: Optical intersatellite links

Valuation: $226M (market cap), Last Financing: IPO, Nov 2021

BridgeComm (Private)

Products: Optical intersatellite links

Valuation: $37.5M (post), Last Financing: $10M, Sep 2018

Space Micro (Acquired)

Products: Optical intersatellite links

Valuation: Undisclosed, Last Financing: Voyager Space Holdings M&A, Nov 2021

Kepler Communications (Private)

Products: LEO orbital data relay network

Valuation: Undisclosed, Last Financing: $60M, April 2021

SpaceLink (Public, Subsidiary of EOS)

Products: MEO orbital data relay network

Valuation: $191M (market cap), Last Financing: On Australian exchange for 30+ years

Mangata (Private)

Products: MEO-HEO orbital network, ground micro data centers

Valuation: Undisclosed, Last Financing: $33M, Feb 2022

Ramon.Space (Private)

Products: In-space compute hardware

Valuation: Undisclosed, Last Financing: $17.5M, May 2021

Nebula Compute (Private)

Products: On-orbit data centers

Valuation: Not priced round, Last Financing: $1.25M, Sep 2021

Cosmic Shielding (Private)

Products: Doped polymer radiation shielding material

Valuation: Not priced round, Last Financing: $1M, April 2021

Most of the companies in this landscape are quite mature. A nascent area to keep an eye on over the next couple years is quantum communications, with an exciting experiment launching to the ISS later in 2022.[90] (In fact, NSR reports 30 different quantum communications payloads scheduled to launch by 2030.[91]) The promise of quantum communications is one potential approach to secure communications. MIT Lincoln Lab developed the “protected tactical waveform”[92] for DOD encrypted communications. The Space Force has up to $5B budgeted to build a secure unjammable space-based communication architecture.[93]

Conclusion

The satellite communications sector is currently going through a period of exponential growth, driven by two complementary macro trends – the reduced cost of launch and Moore’s Law making electronics smaller, more capable, and lower power. Additionally, electric propulsion, phased array antennas, and optical inter-satellite links have enabled the emergent slim form factor design for LEO mega-constellations. SpaceX has demonstrated the feasibility of the LEO mega-constellation business case: Starlink sells fiber-quality broadband internet to consumers living in remote locations. Beyond broadband, other interesting market sectors to watch include IoT and 5G backhaul via direct-to-cell-phone service. Optical inter-satellite links and the high volumes of Earth Observation data are driving the nascent in-space compute market, with data centers in-space helping to create an environment of real-time actionable intelligence via data fusion and machine learning. Turbulent times have been a somber reminder of the importance of space-based data and communications for helping billions of lives here on Earth.

References

[1] Stein, E.V., Launch Cost and Cadence Are Key Enablers for the New Space Economy, October 2021

[2] Stein, E.V., Bottlenecks in Rocket Engine Production May Slow the Space Economy Flywheel, January 2022

[3] Press, L., A New Chinese Broadband Satellite Constellation, October 2020

[4] Starlink 1007, NASA Space Science Data Coordinated Archive, NASA

[5] Holst, J., Project Kuiper's Imaginary Rocket, Ill-Defined Space Substack, November 2021

[6] OneWeb Satellite Constellation, Wikipedia

[7] Telesat Lightspeed Specifications Sheet, Telesat

[8] Lemur-2 Nanosatellite Constellation of Spire Global, eoPortal

[9] Jewett, R., FCC Authorizes Boeing V-Band LEO Broadband Constellation, Satellite Today, November 2021

[10] u/winpickles4life, AST SPACEMOBILE - The Starlink of Smartphones, r/ASTSpaceMobile subreddit, October 2021

[11] Lynk Files for FCC License to Enable Global Mobile Connectivity, Lynk

[12] Brodkin, J., Firm Planning 100,000 Satellites Claims It Will “Clean Space” by Capturing Debris, Ars Technica, February 2022

[13] Foust, J., European Union Advances Broadband Constellation Despite Negative Assessments, SpaceNews, February 2022

[14] Messier, D., Russia’s Sphere Satellite Constellation Moves Toward Implementation, ParabolicArc, January 2022

[15] Wang, B., Version 2 Starlink with Lasers and Gen 2 SpaceX Starlink Bigger and Faster, September 2021

[16] McDowell, J., Constellation Models, accessed March 2022

[17] Quilty Analytics, LEO Broadband Special Report Series, February 2020

[18] NSR, Satellite Communications

[19] Lionnet, P., Twitter thread on Satellite Constellation Economics, October 2021

[20] Pachler, N., et. al., An Updated Comparison of Four Low Earth Orbit Satellite Constellation Systems to Provide Global Broadband, IEEE International Conference on Communications Workshops, 14-23 June 2021, INSPECT #21098901

[21] Lifson, M. and Linares, R., Is There Enough Room in Space for Tens of Billions of Satellites, as Elon Musk Suggests? We Don’t Think So., SpaceNews, January 2022

[22] Holmes, M., Steve Collar Part Two: SES Will ‘Likely’ Leverage LEO in Multi-Orbit Future, Satellite Today, January 2022

[23] Griffin, T., Twitter post on Future Multi-orbit Architectures, February 2022

[24] Kisseleff, S., et. al., Radio Resource Management Techniques for Multibeam Satellite Systems, IEEE Communications Letters, October 2020

[25] Cakaj, S., et. al., The Coverage Analysis for Low Earth Orbiting Satellites at Low Elevation, International Journal of Advanced Computer Science and Applications, Vol. 5, No. 6, 2014

[26] SES, GEO, MEO, and LEO, Via Satellite

[27] Keller, J., DARPA Hires Seven Companies, Spends More Than $100 Million, To Reinvent the RF Phased Array Antenna, Military & Aerospace Electronics, April 2014

[28] What is a Phased Array Antenna?, everything RF

[29] CesiumAstro Secures $60 Million in Oversubscribed Series B Funding, Businesswire

[30] Global Flat Panel Satellite Antenna Market Size, Manufacturers, Supply Chain, Sales Channel and Clients, 2020-2026, 360 Research Reports, August 2020

[31] In-Space Propulsion, State-of-the-Art Small Spacecraft Technology Report, Small Spacecraft Virtual Institute, NASA

[32] Werner, D., Orbion Wins Contract To Demonstrate High-thrust Propulsion, SpaceNews, August 2021

[33] Solar Electric Propulsion (SEP), Space Technology Mission Directorate, NASA

[34] Zorpette, G., How the Hall Effect Still Reverberates, IEEE Spectrum, January 2022

[35] Astra Acquires Apollo Fusion To Reach New Orbits, Astra

[36] Accion Systems Raises $42 Million in Series C Led by Tracker Capital, Accion Systems

[37] Space Propulsion Market by Type (Chemical Propulsion, Non-chemical Propulsion), System Component (Thrusters, Propellant Feed System, Nozzle), Platform (Satellite, Launch Vehicle), Orbit, End User, Orbit, Support Service, Region - Global Forecast to 2025, Markets and Markets, October 2020

[38] Henry, C., Mynaric Raises $12.5 Million From Mystery Constellation Customer, SpaceNews, March 2019

[39] Erwin, S., CACI Ramping Up Production of Optical Terminals for Low Earth Orbit Satellites, SpaceNews, January 2022

[40] Laser Communications Relay Demonstration (LCRD), Space Technology Mission Directorate, NASA

[41] Erwin, S., Space Development Agency, General Atomics Eye Options After Setback in Laser Comms Experiment, SpaceNews, February 2022

[42] Erwin, S., DOD Space Agency Funds Development of Laser Terminal That Connects to Multiple Satellites at Once, SpaceNews, March 2022

[43] Tesat-Spacecom To Establish U.S. Manufacturing Facility, SpaceNews, February 2022

[44] Mynaric Receives Optical Comms Contract From The ESA, SatNews, February 2022

[45] Erwin, S., DOD Wants ‘Resilient’ Space Systems, but How To Get There Is Still Unclear, SpaceNews, March 2022

[46] Jewett, R., Isotropic Demonstrates GEO, MEO Satcom Link to the US Army, Satellite Today, February 2022

[47] Donnison, A., Interoperability Brings Satellite Communications Infrastructure Into the Digital Age, Satellite Today, February 2022

[48] Levi, A., Metamaterials, Prime Movers Lab Thought Paper, October 2021

[49] Stevenson, R., et. al., Metamaterial Surface Antenna Technology: Commercialization Through Diffractive Metamaterials and Liquid Crystal Display Manufacturing, 10th International Congress on Advanced Electromagnetic Materials in Microwaves and Optics – Metamaterials 2016, Crete, Greece, 17-22 September 2016

[50] Rainbow, J., Kymeta Plans to Release OneWeb Terminal by Next Summer, SpaceNews, December 2021

[51] Jewett, R., Kymeta and Kratos Form Partnership to Combine Antenna and Virtual Ground Technologies, Satellite Today, February 2022

[52] Satellite Industry Association & BryceTech, State of the Satellite Industry Report, June 2021

[53] A New Space Economy on the Edge of Lift Off, Morgan Stanley, February 2021

[54] Highfill, T., Jouard, A., and Franks, C., Updated and Revised Estimates of the U.S. Space Economy, 2012–2019, Bureau of Economic Analysis, U.S. Department of Commerce, January 2022

[55] Crane, K., Linck, E., Lal, B., and Wei, R., Measuring the Space Economy: Estimating the Value of Economic Activities in and for Space, Institute for Defense Analysis - Science & Technology Policy Institute, March 2020

[56] Daehnick, C., Klinghoffer, I., Maritz, B., and Wiseman, B., Large LEO Satellite Constellations: Will It Be Different This Time?, McKinsey, May 2020

[57] Holmes, M., Credit Suisse Report Says LEO Constellations Will be Challenged by Increasing Data Use, Satellite Today, January 2022

[58] Farrar, T., Op-Ed | Leo Broadband: Will This Time Be Different?, SpaceNews, January 2022

[59] McKetta, I., How Starlink’s Satellite Internet Stacks Up Against HughesNet and Viasat around the Globe, Ookla Insights, August 2021

[60] Boyle, K., Can Starlink Save the American Mother?, The Rambler Substack, January 2022

[61] BroadbandUSA, Indicators of Broadband Need, ArcGIS Online

[62] Rainbow, J., UK Funds Beam-hopping Satellite for OneWeb-led Consortium in 2022, SpaceNews, May 2021

[63] Rainbow, J., Satixfy To Go Public Through Latest Space SPAC Deal, SpaceNews, March 2022

[64] NSR, Aeronautical SATCOM Markets, 9th Edition, June 2021

[65] NSR, Maritime SATCOM Markets, 9th Edition, July 2021

[66] Farrar, T., Twitter thread on AST Space Mobile Technical Feasibility, July 2021

[67] Werner, D., Lynk Satellites Connect With Thousands of Devices, SpaceNews, February 2022

[68] Hardesty, L., Vodafone Works With AST SpaceMobile to Close Digital Divide, Fierce Wireless, February 2022

[69] Lynk Global Inc. Signs Contracts with MNOs to Bring Satellite-Direct-to-Phone Connectivity to Seven Pacific and Caribbean Island Nations, BusinessWire, February 2022

[70] 5G Fund, FCC

[71] Nelius, J., SpaceX's Still-in-Beta Starlink ISP Gets Nearly a Billion Dollars to Try and Fix Rural Internet, Gizmodo, December 2020

[72] Rocket Lab Selected by MDA to Design and Build Spacecraft for Globalstar, Rocket Lab

[73] NSR, M2M and IoT via Satellite, 12th Edition, September 2021

[74] Sheetz, M., SpaceX Is Buying Satellite Data Start-up Swarm, in a Rare Acquisition by Elon Musk’s Space Company, CNBC, August 2021

[75] Mohney, D., IoT-Ish Fleet Space Technologies Secures $26.4M B Round Funding, Space IT Bridge, November 2021

[76] Hendry, J., Fleet scores $20m grant for Adelaide satellite factory, IoT Hub, March 2022

[77] Astrocast goes public and attracts Palantir as investor, Startup Ticker, August 2021

[78] Jewett, R., Iridium’s IoT Subscriber Growth Drives Another Year of Record Revenue in 2021, Satellite Today, February 2022

[79] Ground Data Systems and Mission Operations, State-of-the-Art Small Spacecraft Technology Report, Small Spacecraft Virtual Institute, NASA

[80] Space Development Agency Makes Awards for Tranche 1 Transport Layer, Space Development Agency (SDA), Department of Defense

[81] Data-Relay System Connects Astronauts Direct to Europe, The European Space Agency (ESA)

[82] Sheetz, M., Kepler Communications Raises $60 Million Expand Network, Add US Office, CNBC, June 2021

[83] Rainbow, J. and Werner, D., Spacelink Hires OHB to Build Data Relay Satellites, SpaceNews, October 2021

[84] Bell, J., For Your Information: A New Approach to Connectivity—Why We Invested in Mangata Networks, Playground Global, February 2022

[85] Ramon.Space Announces High-Capacity Space-Resilient Storage Solution, Ramon.Space

[86] Jewett, R., 2020: A Year of Dramatic Change in the Satellite Industry, Satellite Today, December 2020

[87] Strout, N., Lockheed Martin Experiments With a Mesh Network in Space, C4ISRNET, January 2020

[88] Erwin, S., Space Development Agency Experiment Demonstrates On-Orbit Data Processing, SpaceNews, February 2022

[89] U.S. Frequency Allocation Chart, National Telecommunications and Information Administration (NTIA), Department of Commerce

[90] Torbet, G., Experiment Into Quantum Communications Is Heading to the ISS, Digital Trends, March 2022

[91] NSR, The Quantum Race for Secure Communications, October 2021

[92] Protected Antijam Tactical SATCOM, Lincoln Laboratory, MIT

[93] Hitchens, T., Space Force Wants $5B For Anti-Jam SATCOMs, Breaking Defense, February 2020

[94] Introduction to the Electromagnetic Spectrum, NASA Science

Appendix

The Electromagnetic Spectrum. Areas in gray indicate parts of the spectrum where the atmosphere blocks the signal.[94]