The Electricity Grid

Liza Reed, PhD, Fellow

December 2022

Introduction

The National Academy of Engineering named electrification as the most important achievement of the 20th century for its impacts on quality of life in the developed world.[1]

The impact of electrification will only grow in the 21st century because the grid is the backbone of a clean energy future.

Electrification and carbon-free energy generation require a stronger electricity grid — one that can move more power over longer distances while also supporting new loads like electric vehicle charging and energy-intensive industrial processes, and providing reliable service through more extreme and variable weather conditions.

Decarbonization models suggest that the US transmission system will need to double in capacity or more[2, 3] — not necessarily twice as many lines, but twice as much capability of carrying power over distance. More high-power lines would mean fewer miles added, and existing electrical lines can be upgraded to get many more times the power through the same or similar land footprint.

The existing grid system has been built around one-way flow — from power generation to load. It needs widespread deployment of sensing and control systems for managing two-way flow — where power could come from a rooftop solar power or home battery system just as easily as from utility scale power plants.

At Prime Movers Lab, we have a deep interest in addressing the global challenge of climate change. The grid is at the intersection of two of our verticals – energy and infrastructure. We recognize that transforming the electricity grid is a linchpin for clean, abundant energy access. To understand what the grid needs and where the solutions are, we have spent time speaking with numerous companies developing grid hardware technologies and software services as well as investment and policy experts. What follows is a summary of what we have learned, primarily focused on the US electricity grid but with insights that are applicable globally.

Understanding the Grid[4]

What Is the Grid?

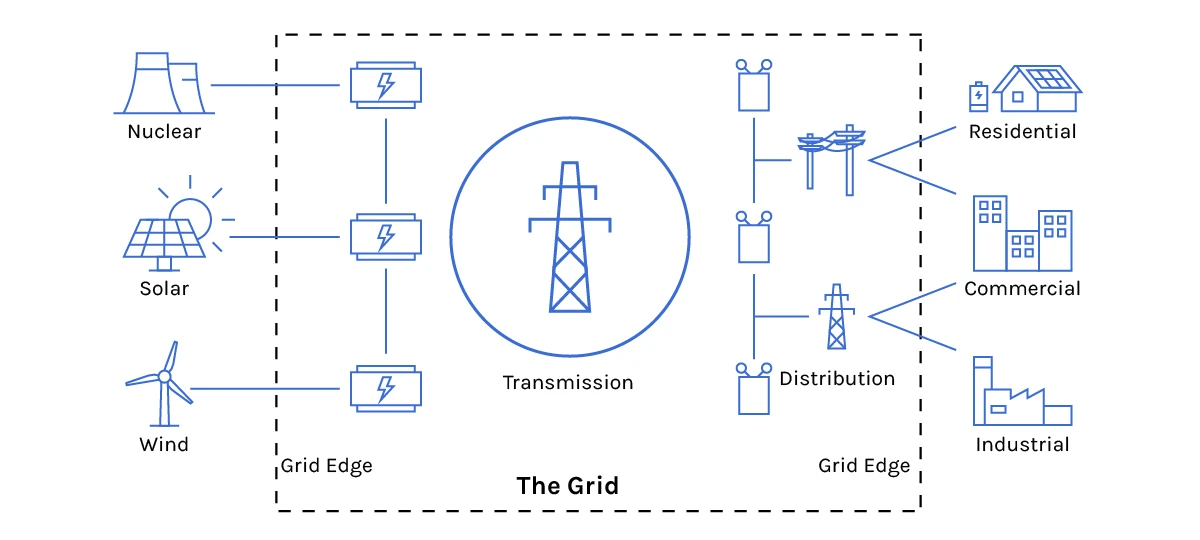

The electricity grid spans from the power electronics systems that connect generation sources to electric wires, through high voltage transmission lines, electric substations and converter stations, to the distribution lines that run through cities and towns and into the breakbox in a home or business. From a technology perspective, it’s easiest to think about in 3 buckets:

The Transmission System is the wires that traditionally connect large power plants to distribution substations. Hundreds of thousands of miles of interconnected high voltage transmission lines (>100 kV) primarily bring power from a plant towards a population center.[5] They move power over distance for bulk power purchase.

The Distribution System is the wires, sensors and substations that traditionally bring power to homes and businesses. There are more than a million miles of distribution lines in the US.[6] This flow of power has been primarily one way, from the system into the home, but that is changing with distributed energy resources.

The Grid Edge is at either end of the system, the technology that integrates power generation sources or integrates loads. This includes inverters that convert, for example, rooftop solar or EVs to grid compliant power, smart meters that measure consumption, and smart circuit breakers or other management systems that may have control of the systems and appliances behind the meter. With the growth of rooftop solar, battery walls, and electric vehicles, these previously distinct edges are blurring into each other. The challenges at the grid edge are power sensing and control. Managing a lot of small resources is functionally different than managing a few large resources. The data needs, response time, and number of interactions is much higher with many small resources. The way large resources interact with the system is also different than how small resources interact. This is a fast growing area for hardware and software solutions. Grid edge includes vehicle-to-grid and building-to-grid solutions.

Conceptual drawing of the electricity grid. For the purposes of this landscape analysis, the grid is divided into 3 buckets: transmission, distribution, and grid edge. Power generation and end use are considered outside the grid.

For the most part, tech still falls into one of these buckets. Virtual power plants, largely a conceptual idea in most parts of the US due to lack of incentives, would further blur the edges, as conceivably they could aggregate resources at the distribution scale and participate in the transmission scale power markets, remunerating individuals for allowing their vehicle, storage, or generation assets to be managed and used by the grid. Broadly, it is a collection of energy assets that are managed together to respond to grid signals and are compensated according to providing that service. In the later landscape analysis, VPPs are categorized as grid edge to specify that the owner and manager of the tech described is not the distribution utility, but this is not a required differentiation.

The Grid Is THE Bottleneck for Decarbonization[7]

The electricity grid is the bottleneck for decarbonization, particularly in countries like the US with a highly developed grid infrastructure. Every decarbonization study finds that the US needs to dramatically expand the transmission system to decarbonize by 2050, even after accounting for local resources.[8, 9, 10, 11] It’s simple economies of scale. Rooftop and community solar, and home and EV batteries, can only go so far, especially any place other than the southwest, and those investments must be made everywhere. Electricity transmission allows a single investment to aggregate and provide power to multiple regions. In 2020, MIT looked at decarbonization pathways at various scales, and found that more regionalization led to less expensive overall systems and more system benefits.[12]

This expansion is needed to accommodate new loads and new sources of generation. EV adoption is the most salient in the news and short term driver of grid technology changes, but electrification of home heating and decarbonization of industrial loads will also drive more demand.[13] At the same time, clean energy sources are in different locations than existing fossil fuel infrastructure. These new generation sources need transmission to connect them, and their variability compared to fossil fuel generation means the transmission system must aggregate, move, and smooth electricity flow more effectively in the coming decades.

It’s not just a grid capacity increase, it’s a capability increase that’s required.

This is not to discount the need for investment in local solutions, especially technology solutions. In the 2022 summer heat wave, Southern California imported a lot of energy, but it also asked its residents to reduce their consumption, something called “demand response.”[14] Demand response could be so much more than simply manually reducing consumption, though. In extreme cases, where the power demands could not be met, rolling blackouts could be replaced, or at least tempered, by selective energy management — utilities turning off water heaters or adjusting thermostat settings and EVs providing power back to the grid are just the tip of the iceberg for what a democratized system could provide — with the right technology in place.

Decarbonizing the US grid will require a $3-5 trillion investment in power infrastructure.[15]

The traditional business model of this expenditure is captured by regulated monopolies, but the democratization of energy, through local and personal ownership of energy assets, is changing how the grid functions and may change business models and expand the possibilities for market entry.

This landscape is largely focused on the US case, which has a lot of overlap with Europe from a technical challenge perspective but different regulatory structures. Electrification is creating grid technology opportunities globally, too, of course. Developing grids face similar challenges as the US, but with both more flexibility to build smart-from-the-start solutions, and less reliable infrastructure as a backbone off which to develop and deploy.

Regulatory Barriers to Transforming the Grid

Though the grid is sometimes compared to the highway system, building it out and managing it is far more complex. A traffic jam in NYC does not cause a traffic jam in Nashville, but the interconnected grid can have such far-reaching consequences without sufficient management. And electricity must be used as it is generated — the electrons can’t show up 30 minutes late because of a detour. Adding more storage to the grid will help this last aspect of course, but the operations challenge still remains. Storage is just another component that must be managed to ensure the electrons are all still accounted for.

This complexity makes most utilities risk-averse. In most cases utilities are operated as regulated monopolies – they are allowed to make business and infrastructure decisions without fear of competitors, but must make their case to regulators to recover their costs from rate payers. The regulated monopoly structure does not incentivize innovation or maximization of infrastructure use. It also makes it difficult to build high power lines to move power across states.[16]

There are approximately 3,000 distribution utilities in the US, with various ownership and regulatory structures.[17]

Of those, 150 are investor owned utilities that serve 70% of the population and 50% of the land mass. That leaves 2800 utilities that serve everyone else, including public power providers and rural electric co-ops. This is a highly fractured market with powerful incumbent providers (both the utilities and the corporations that provide their hardware and software management solutions. The transmission system is also fractured and captured, though there are overall fewer players in the space.[18] Together, these factors make adoption and scale of solutions difficult.

At the transmission scale, much of the tech needed exists but implementation is stymied by the policy barriers. Utilities manage their own costs and footprints, and state regulators review those expenditures with state goals and outcomes in mind. This is a major barrier for transmission technology that can increase efficiency (as it does not provide higher returns for investors in many cases) and transmission systems that cross boundaries (as they disrupt existing business models, including the economics of existing power plants). There is very limited federal authority to support interstate electricity commerce, even though studies show this is better overall for consumers in terms of cost and resilience.[19]

At the grid edge (e.g. the residential meter), there are hardware and software tech solutions that need to be proved out and then deployed at scale to change the way electricity is used. This area has seen the most innovation lately because it is experiencing the most technology changes: smart thermostats, electrified heating, and electronic vehicles are changing how (and how much!) consumers think about electricity. There are still data access and integration issues that must be tackled to reach the full potential of distributed resources, though.

An Electricity Primer[20]

Electric power (P), measured in Watts is the product of voltage (V), measured in Volts and current (I, so abbreviated because it used to be called intensity), measured in amperes (amps).

Transmission of power faces resistance in the wires (R), measured in ohms. Power is lost due to resistance and current:

Increasing either power component, voltage or current, results in more power, but only current contributes to electrical losses. Thus, a high voltage, low current system is more efficient than a low voltage, high current system. Resistance of wires increases with distance, so this tradeoff is especially important for longer distance lines.

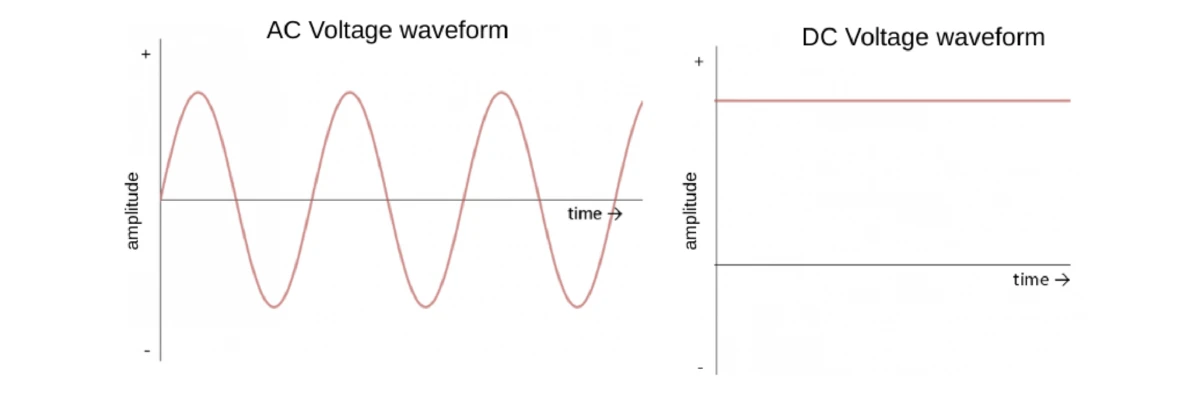

Alternating Current

Alternating current is so named because the current follows a sinusoidal pattern, alternating between positive and negative. In the US, Canada, and most of Central and South America this wave alternates with a frequency of 60 Hz (60 times per second). In Europe, Australia, and most of Asia and Africa the grid alternates at 50 Hz.[21]

Japan famously has a grid that is half 50 Hz, half 60 Hz because the UK and the US each rebuilt one side of the island, using their standard equipment. At the seam of these systems are DC stations to allow power transfer to happen. Differences in frequency are just one example of how grid solutions are complicated and not universal.[22]

AC voltage versus DC voltage

This variable pattern allows AC systems to leverage fundamental electrical and magnetic properties of some metals to transform power from low voltage to high voltage and vice versa.

AC systems can easily increase voltage to move power efficiently.

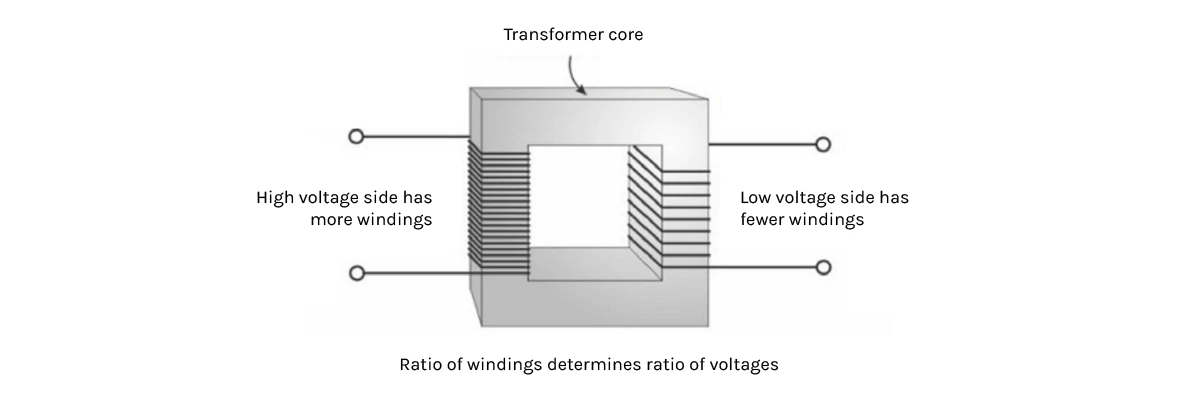

The traditional transformer consists of two sets of wire windings around a core.

AC transformers are the key to AC efficiency in transmission of electric power. Imaged adapted from ElProCus[23]

The ratio of the windings determines how the voltage is transformed. If the input has 4 times the coils as the output (4:1), then the output voltage will be ¼ the input voltage, For example, 480- kV would step-down to 120 kV. The same is true in reverse. To get a higher voltage, the input power should have fewer coils than the output power. Reversing the above, a 1:4 ration would step the voltage up from 120 kV to 480 kV. This is the key to AC’s advantage in electricity transmission.

Direct Current

A DC system, in contrast, maintains a constant (or direct) flow, and cannot tap into those electro-magnetic properties.

The easiest way to change the voltage of a DC system is to convert it to AC, increase the AC voltage, and convert back to DC! This is why we have an AC dominant systems across the globe – when Edison and Westinghouse battled it out in the 1890s, Westinghouse’s AC system was far more efficient.[24]

AC continued to dominate the electricity system throughout the 1900s because it was inexpensive, and HVDC conversion technology was cumbersome to operate. 100 years ago the only way to convert from AC to DC was by using an inefficient motor. The only high voltage DC (HVDC) in the US grid (less than 1% of US transmission miles[25]) was built for applications where AC was not suitable. It is difficult for AC systems to maintain stability over long distances, so HVDC systems were built to move hydropower that was remotely located to population centers. The electromagnetic properties that make AC systems highly efficient work best above ground. Underground or undersea AC lines create interference resulting in inefficient lines, so DC systems are also used for many underwater transmission needs such as crossing the Long Island Sound or routing through the San Francisco Bay. It is also an attractive option for the growing offshore wind industry.

The desire for long distance and underground lines is growing, and recent advances in technology provide additional benefits, making the case for more HVDC.

The first grid integration of AC and DC was in the 1940s, using mercury arc valves to convert DC power from a dam. In the 1970s, thyristors (the first semiconductor based solutions) were used and are now the dominant technology for DC in the grid. In the late 1990s, ABB demonstrated a new technology based on transistor, called voltage source conversion, that, while not yet dominant in the grid from a use perspective, is certainly dominant in project proposals, due to its ease of integration with the AC system, applicability for off-shore wind, and ability to accommodate multiple terminals (the DC version of power substations that provide power to towns along the path).[26]

The Great Grid Debate: Macrogrids or Microgrids?

The grid is constantly in tension, and grid policy is too. One of the tensions is about the size of the grid – should it be bigger or smaller, more connected or less connected?

Abandoning Transmission

Some argue that with the growing capabilities and plunging costs of solar and storage, and the increasing difficulty of siting transmission lines, that microgrids are the answer. The grid should abandon transmission solutions and look to create many small grids that are self-sustaining. There are attractive aspects of this approach: independence from utility capture which can seem expensive and inscrutable to the consumer, community ownership of assets which could provide solutions to both equitable access and self-reliance. Following extreme weather conditions that take out transmission and distribution infrastructure this chorus often resurges.

Microgrids are difficult to design and implement because distributed energy resources don’t use a standard communication protocol.

The industry is still in a developing stage, with each provider trying to capture the market with proprietary technology, software, and data.

The cost calculation varies widely depending on where in the US or where in the world it is estimated. There is also an issue of vulnerability to extreme weather, or even accidents or attacks. While disconnection insulates a community from issues happening elsewhere on the grid, without an interconnected system, it’s difficult to import power to support their own failing assets. This is not to say there isn’t an important role for microgrids. In the wake of Hurricane Ida, microgrids were used to support communities while the grid was repaired. Solar assets were trucked in to provide support that extended the diesel fuel supply. Completely self-sustaining microgrids are very different from communities that can temporarily disconnect themselves and self-sustain critical areas for short periods of time. This is a valuable capability for hospitals and could be expanded to communities in every town as a resilience investment.

In countries with developing electricity infrastructure, clean energy microgrids are essential stepping stones to a clean energy future.

National Transmission System

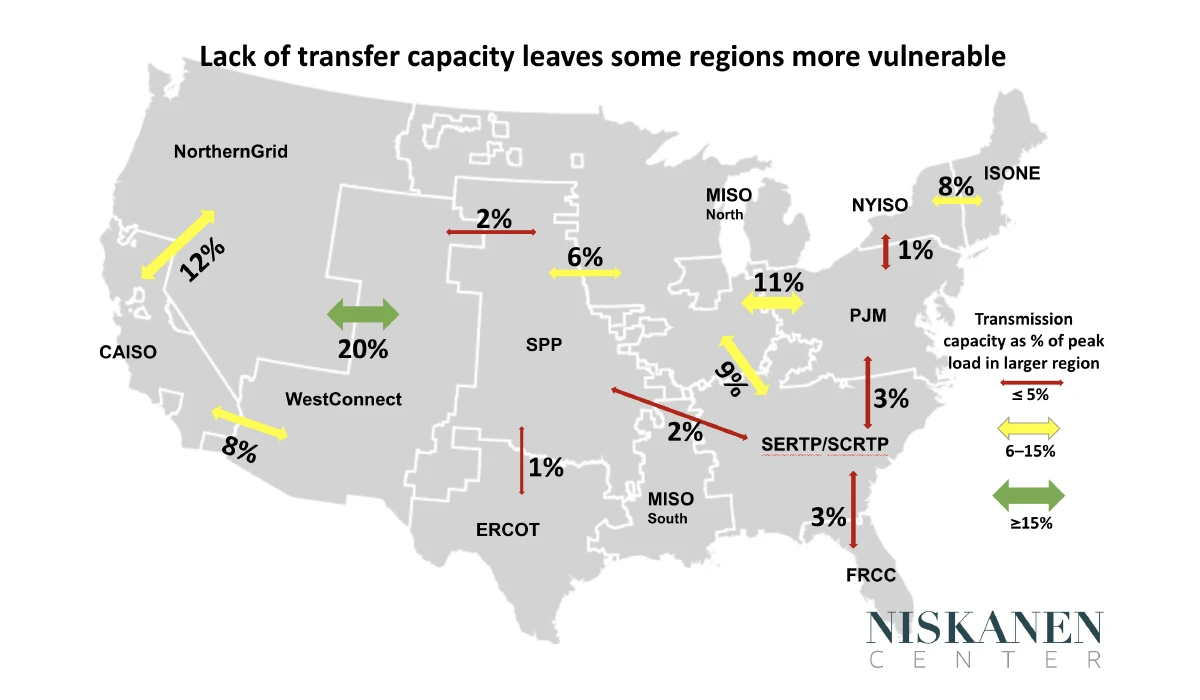

At the other end of the spectrum is the idea of a highly connected grid. In the US, grid connectivity varies widely, which impacts energy prices and grid resilience.

The US electric grid is not well connected today, leaving some regions vulnerable. Graphic adapted from Niskanen Center[27]

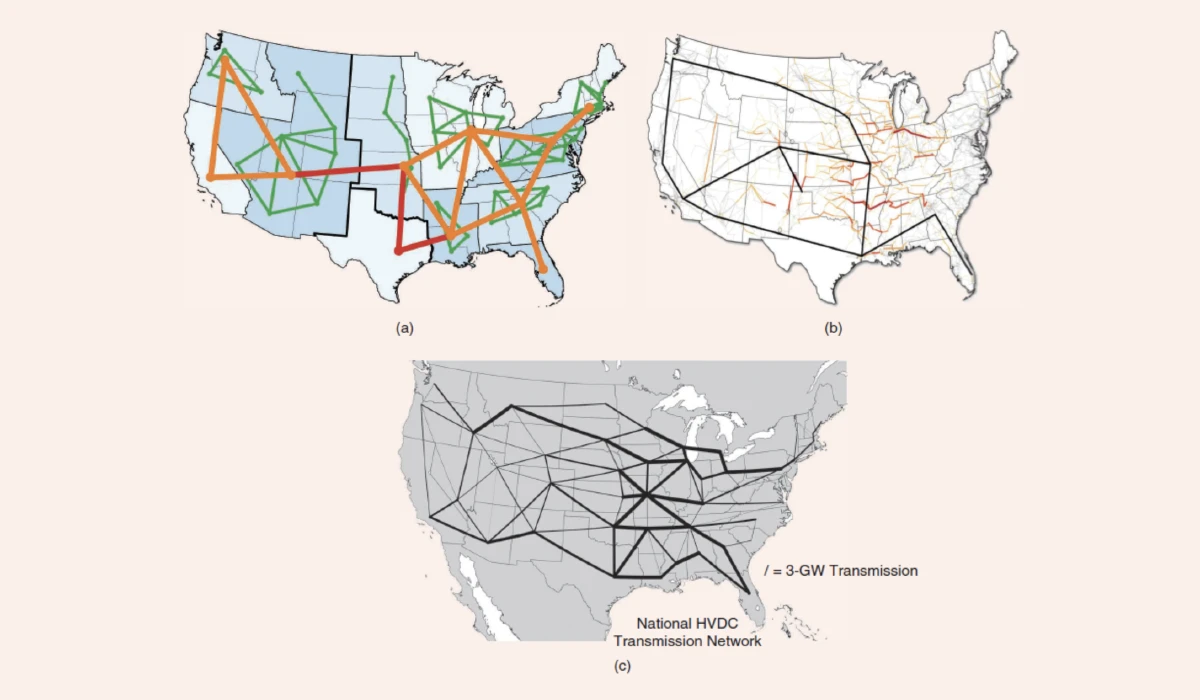

Proposals for interconnecting the US grid with an overlay of HVDC lines have come and gone over the past 50 years, but are a growing chorus in the most recent iteration, including a Macrogrid initiative of interested groups.[28] It is a technically driven solution, that has many potential upsides for the electricity system as a whole, but a large price tag with major regulatory barriers, diffuse and diverse stakeholders, that solves a lot of potential pain points in decarbonization, but not one in particular. Though accurately touted as a least cost solution, those costs are borne differently by each utility, and interrupt the business models of the companies that would need to support it.

Example Macrogrid proposals: Continent-spanning networks of HVDC lines to integrate clean energy into a resilience and least cost electricity grid. Image Source: IEEE Power and Energy Magazine[29]

One step further in the technology and regulation innovation landscape is to bury the HVDC system along highway or rail rights-of-way.[30] This solves a pain point of land access and land impacts, and potentially addressed those opposed to the look of transmission lines. The challenge is cost and maintenance – who will bear the extra cost of burying lines, and how will they be maintained? This is not to say the issue should not be investigated or invested in – merely to point out the challenges are a mix of economic, regulatory, and technological.

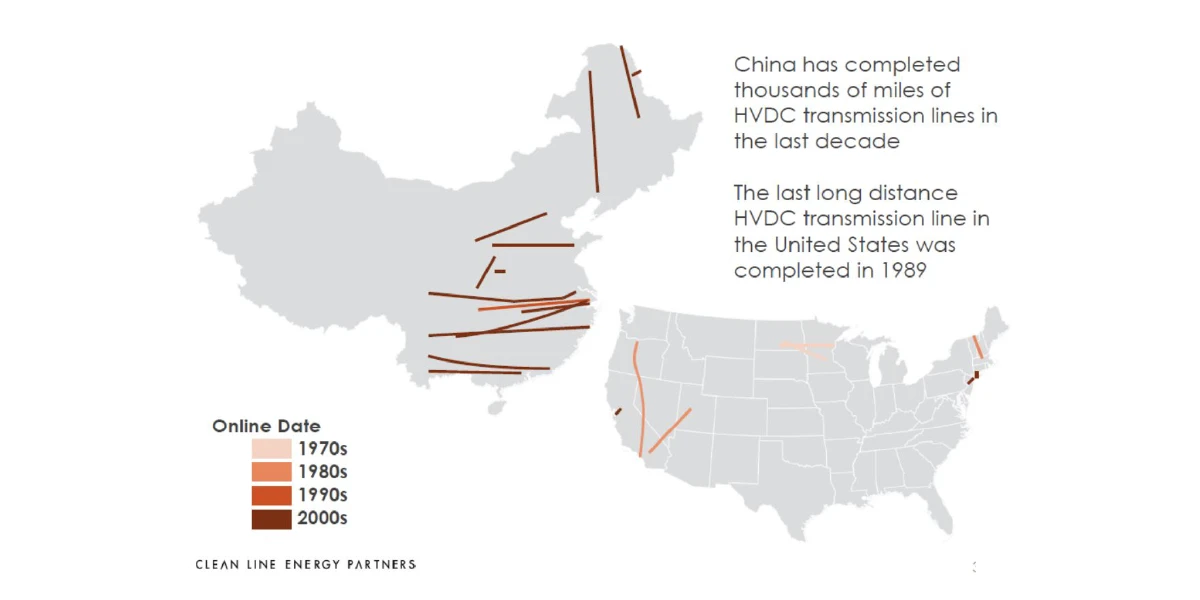

Quickly expanding national HVDC infrastructure is possible, just look at what China has done in the last 20 years. This is not an endorsement of China’s regulatory or economic approach, but an illustration of differences, in particular to point out that HVDC is being used in practice. It is not a technical idea with no home, it just has not yet expanded its niche in the USA.

Comparison of HVDC growth in China and the US. Source: Ramez Naam[31]

Solutions to Growing Pains

Each of the three grid buckets (Transmission, Distribution, and Grid Edge) need hardware and software solutions. What follows is an overview of key technical opportunities and some companies working to address them. This overview is to help illustrate different approaches; it is not a comprehensive assessment of all of the active companies nor an endorsement of any company or approach. All information is gathered from Pitchbook, pitch decks, and company websites except where otherwise noted. Missing from this landscape, for the sake of tractable analysis, is physical and cyber security of the grid. Start ups and legacy developers have developed solutions for monitoring for wildfire risk and upgrading outdated software platforms while protecting privacy and access in an increasingly digital grid. These are an important part of the future of the grid as well.

Transmission

Analytics

Transmission systems need better software for managing their grid topology – that’s the fundamental way that power flows through the system. Electricity flows to the path of least resistance. NewGrid has an analytical platform that looks at power flows on the transmission system and can optimize circuit routing in real time to save on congestion costs (the increase in energy prices when the power cannot flow where it’s needed). Effectively they find new routes for the electricity to flow. Pearl Street Technologies proves a similar service but for transmission planning. When a new power plant wants to connect to the grid, the grid operator must perform a prospective analysis of what transmission will be needed to support the power flow changes that will result. These studies are slow and error prone because the legacy planning software is not designed around renewable resources and requires a lot of manual customization. Pearl Street found a novel way to identify, fix, and rerun the analyses until there is a solution, an automation step that is saving time and money for grid operators already.

Hardware+

SmartWires (STO: GOGRID) provides hardware solutions that change the dynamics of power flow where they are installed, in essence changing the “resistance” (technically, it’s more complex physics called reactive power), which both increases grid stability and maximizes the use of the existing system by increasing the power flow to underutilized lines. This is increasingly useful as transmission lines become harder to build, because it allows a better use of the existing system. However, the regulated monopoly structure of most utilities in the U.S. does not incentivize operational optimization as there is no return on cost savings. In the U.K., in contrast, the regulated model does allow for financial returns for efficient systems. This technology has seen better adoption in Europe than in the US thus far, though these dynamics may change as the grid continues to change.

Transmission lines are rated for how much power they can move in different weather conditions, but traditionally grid operators have only had high level weather reports to determine system limits. LineVision installs sensors along transmission lines to detect the microclimates and line conditions, which are communicated back to the grid operators who can take action on increasing or decreasing allowable power flow. This is called Dynamic Line Rating (DLR), as opposed to the static line rating that cannot take into account the unique conditions of each line at each point in time. LineVision just announced a partnership with GE Grid Solutions (GE) to combine DLR with other system optimization tools to provide a comprehensive dynamic power flow solution to grid operators.[32] Partnership with or acquisition by incumbent grid hardware companies is a trend in the industry.

Conductors, Superconductors, and Enabling Tech

Transmission of electric power can be very inefficient, especially over long distances. The resistance of the transmission line (also called the conductor in overhead applications) results in heat losses. Heat losses reduce the total power delivered and can limit maximum power deliverable at a given voltage. The result is that higher voltages, and correspondingly higher towers and larger corridors are required to increase transmission capacity. In addition, the heating of lines can contribute to line sagging. The heat from losses physically expands the metal in the lines, which increases sagging between towers. These sagging lines can be hazardous because they can get too close to the ground or trees (especially in windy conditions) and short the system. The amount of heat losses and sag depend on the conductor materials. Two conductor technology innovations are able to increase the capacity of lines and reduce the sag, by making the lines stronger and less resistant. The core of a conductor is typically steel, but a new set of conductor technologies include a composite core that is much stronger. These conductors can transfer more power with less sag because they get hot but expand less. They could be used in new corridors for a high capacity design or could replace existing lines and nearly double the power transfer capacity. CTC Global is one supplier of these composite cores. They do not make the lines themselves but they supply the composite backbone to a conductor company that wraps it in aluminum. TSConductor is another advanced conductor company, with carbon cores for strength and trapezoidal aluminum configurations to maximize power carry capabilities. In August 2022, TSConductor announced a joint venture with Starwood Energy that takes a new approach to getting tech on the grid. The venture proposes a financing arrangement for interested utilities to upgrade their existing systems with the more efficient TSConductor lines, and the venture will profit from the savings. This could lower the barriers of adoption for utilities who are reluctant to invest in new technology and are often limited to least cost solutions to limit cost increases to ratepayers.

Advanced Conductors and Super Conductors can get transfer more power on less land. Image sources: TSConductor,[33] MetOx[34]

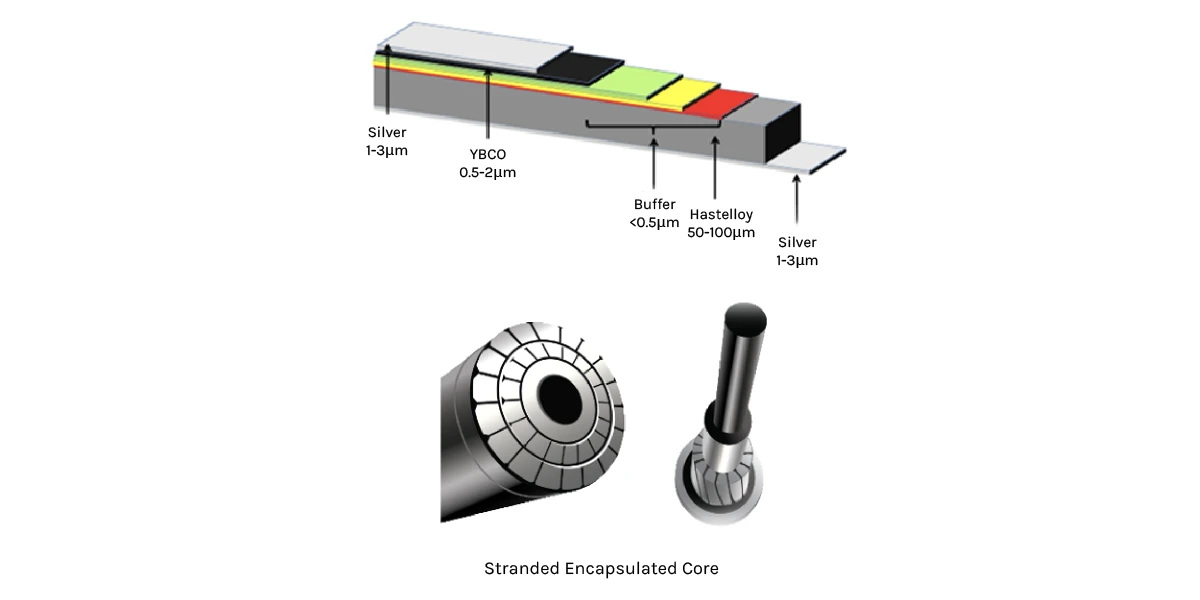

High Temperature Superconductors (HTS) could also be used to increase the capacity of electricity infrastructure. High Temperature Superconductors are a special class of materials that, under certain operating conditions, can transmit electrical current with no resistance. HTS conductors and cables have the potential to increase transmission line throughput 5-10x due to near zero resistive losses.

MetOx is a supplier for superconducting solutions. MetOx uses a Metal-Organic Chemical Vapor Deposition method (MOCVD) for manufacturing superconducting “tapes” (so called because the structure is flat, built up from the layers of deposition, not the usual round wire shape of aluminum conductors). There are a number of other superconducting tape suppliers similarly transitioning from research and development into commercial production. The tapes are capable of superconducting, but a system still needs to provide the cooling mechanism that enables the function. If kept below their critical temperature, superconductors exhibit no electrical resistance. VEIR has developed a liquid nitrogen based evaporative cooling system for superconducting electricity that is capable of both overhead and underground application. Their innovative approach to keeping the conductors cool while making a system light enough and safe enough to use overhead provides a unique potential path towards adoption. Like the carbon and composite core conductors of CTC Global and TSConductor, VEIR lines could be used in existing rights of way and transmission towers, upping the power capacity of a line by 5X without having to get new land, nor acquire digging permits.

Speaking of digging, companies that dig fit better in this category than any other, though the services they provide are not directly related to electricity. Distribution lines are buried underground in some US cities, but this is not a standard practice for transmission lines. The cost estimates are wide: 2X-11X the cost of building overhead lines. Nonetheless, transmission developers are looking into undergrounding as a solution to permitting problems. Underground lines do not need the tall towers that communities sometimes object to. Underground solutions also work better along highways and railways than overhead lines. Innovative undergrounding has potential to disrupt this tension and provide a path through the permitting muck. Petra and EarthGrid are two potential disruptors. They use high heat robotic systems to bore holes quickly. Petra systems bore conduits for utilities through 20 different types of ground, from soft soil to hard granite. Earthgrid proposes to take boring to a new level with enormous (>human sized) tunnels to co-locate, operate and maintain multiple utilities (fiber, water, electric transmission or distribution).

Distribution System

Distribution systems were not built to manage a lot of influx of energy, the monitoring and control is all centered on the energy consumption. Depending on how grid edge solutions come to market and deploy, they may become distribution system solutions. The categorization largely depends on who the customer is – the utility or the retail consumer.

Software

Distributed energy resources (DERs) such as small-scale generation and storage, or integrated EV and rooftop solar systems, change those dynamics and create blind spots for operators resulting in congestion and power flow problems.[35] Distribution systems management can simply mean power flow, but increasingly it is distributed energy resources management system (DERMS), and requires the acquisition and analysis of data on a system that does not necessarily have enough embedded sensors. In some areas, like California, widespread deployment of smart meters and requirements for utilities to provide incentive programs for consumers to conserve energy, this data is more widely available and accessible.[36] Early startups in this space were acquired in the last 12 months by utilities directly or legacy providers. AutoGrid, acquired by Schneider Electric (PAR: SU) started with a platform that leveraged data on EV batteries and other storage solutions like backup power systems to provide distribution flexibility.[35] Their offerings with Schneider Electric now span grid planning and virtual power plant capabilities. Envelio, acquired by E.ON (ETR: EOAN), integrates smart meter data with utilities’ existing system models to create a highly accurate simulation of the grid at all times. This enables faster planning and integration of new assets while maintaining a reliable grid. Opus One Solutions, acquired by GE Digital (NYS:GE), works as an overlay with distribution utilities’ existing systems to provide insight into and management of the state of these distributed energy resources (DERs). OpusOne and GE Digital now provide a service for distribution system management, forecasting, and the development of business models to capture the value of both DERs and grid management efforts.

Camus Energy is a newer entrant, founded in 2019. Their products use distributed high performance computing, enabling real-time analysis and fast and reliable scaling. They aggregate from many available data sources and use machine learning to synthesize missing data, a common issue in the still developing grid IoT, and focus on optimization towards goals – which could be cost management or carbon emissions depending on the customer.

Hardware+

Varentec, acquired by Koch Industries in 2021, provides a similar service to the distribution grid that SmartWires provides to the transmission system. It deploys and manages power electronics devices on the distribution side to control power flow. These systems don't require unique insight into the new additions of rooftop solar, EVs, or small scale DERs to the grid. It’s a hardware solution that changes the dynamics of a given line. This is increasingly important with growing grid-edge technologies that are changing the distribution system functionality.

Switched Source, currently funded by an ARPA-E SCALEUP grant, develops hardware solutions to create a more flexible and resilient distribution grid. The architecture of the distribution grid is hub and spoke, which can leave communities quite vulnerable to a power imbalance while their neighbors are experiencing no problems, and the utility serving them both can do little to fix the issues. The growth of DERs makes these imbalances more likely and also harder to predict for distribution utilities. Switched Source developed an automated tie line that can detect power distribution issues and connect neighboring spokes to ensure reliability is maintained. This both increases grid capacity for integrating DERs and allows utilities to overall manage their systems more efficiently, decreasing the need for new investments.

Grid Edge

The grid edge is where the wires meet the power plant or the load. The increase in distributed energy resources means these previously separate edges are now a bit like a Möbius strip because the power plants and loads can be on the same side of the system.

V2G

Vehicle to grid (V2G) integration is a huge potential area for growth. EV adoption could easily outpace storage adoption, making effective two-way V2G integration the best storage solution available. Fermata and Nuvve (NAS: NVVE) approach the V2G challenge from the hardware angle, developing bi-directional chargers that can charge and discharge EVs, providing power from the vehicle battery back to the grid when needed and charging when electricity is low cost. Fermata’s platform is a vehicle-to-everything approach, incorporating fleet vehicles into a business’s energy management system to reduce peak demand charges, or home integration as power backup in case of a blackout. Nuvve’s approach is more focused on fleets as virtual power plants. It has expanded quickly in the bus electrification market, using their chargers and software platform for fleet management – charging buses with well known schedules and routes at the cheapest times and optimizing asset deployment. WeaveGrid is a software as a service solution to V2G that integrates data from utilities, consumers, automakers and charging infrastructure providers. Their system provides utilities with insights into where EVs are on the grid and their energy use profiles, to improve grid operation and assist in expansion planning. They have additional features for consumer and OEMs to provide more insights into EV charging and usage to optimize the EV ownership experience.

Virtual Power Plants (VPPs)[38]

VPPs can be the aggregation of assets that can provide energy, like local generators, batteries, EVs or solar, which is the most direct definition, though still technically difficult to implement in the distribution hub-and-spoke system as described previously. Grid signals don’t have to just be a need for more power though, they can also be “demand response” signals to consume power, or reduce consumption to maintain the grid balance (electricity must be used when generated or stored).

The two companies highlighted here take the broadest definition of VPPs to track, manage and compensate both providing energy directly and changing demand as requested. In most of the US there are not sufficient incentives for VPP development – i.e. there is not enough value associated with demand response that enables compensation to the consumer. California, however, has a demand response requirement and has the fastest growing tech in this area. OhmConnect and Recurve developed different approaches to the virtual power plant opportunity: how can a consumer capture the value of their assets, including their willingness to decrease their consumption during a high demand time to support grid reliability (demand response)? Recurve is an open source platform that third parties can use to aggregate distributed assets and create virtual power plants. It uses smart meter data to predict, value, and track consumer use, giving a VPP aggregator insight for their market interactions and business model development, including potential financing pathways. The analytics platform can also provide distribution systems management services to utilities. OhmConnect works with the residential consumer, with a system that sends signals during high value times when they should reduce consumption, tracks their load changes and provides payments for their flexibility.

Microgrids

There are a few challenges to renewable energy based microgrids – a holy grail in clean distributed energy: system design, and stability of intermittent resources.

Renew Power Systems (RPSi) is a hardware based solution to the stability issue. This is another deep physics topics, but simply speaking, most distributed energy systems are designed with lower cost “grid following” inverters. They respond to and synchronize with the strong AC signal of the utility’s grid, but cannot create their own stable signal. Renew Power Systems can work with any existing inverter (the technology that connects distributed energy assets to the grid) with an over-the-top hardware addition that provides that stability (called “grid forming”). Grid forming inverters are crucial for widespread renewable energy deployment as fossil fuel plants have historically provided that signal strength and stability. For developing electricity systems, RPSi’s approach enables coordinating inverters to create a stable microgrid.

Xendee is developing a microgrid system design and decision support tool. Microgrid design is a slow process due to conflicting goals and diversity of solution sets. There are lots of tech solutions to put into place, and that decision space is too broad for most customers to consider. Microgrid modelers focus on the technical specs, whereas customers often care about tangibles like cost and footprint (e.g. they have a specific location or set of locations where the solution must go). Xendee cuts customer acquisition time from 18 months to 3 months with a technology agnostic platform that runs on cloud architecture (not complex Excel models) to automate system designs to quickly iterate to meet customer needs.

Developing Technology Areas to Watch

The next 5 years may provide the most breakthrough hardware solutions for the grid, coming out of these verticals.

ARPA-E Investments

In the last five years, the Advanced Research Projects Agency for Energy (ARPA-E) at the US Department of Energy has invested more than $80 million in breakthrough technology ideas across three funding programs that will be the next frontier of tech for the grid:[39]

- Performance-based Energy Resource Feedback, Optimization, and Risk Management (PERFORM), released in 2020, funded 12 projects. These range from models and algorithms to software tools that could be deployed to plan or manage risk of variable resources within the grid. While not hardtech like the rest of this list, these projects will be the foundation for the clean energy transformation. Managing technical risk and market risk are essential for ensuring the transition can happen.

- Building Reliable Electronics to Achieve Kilovolt Effective Ratings Safely (BREAKERS), released in 2018, funded 7 projects aimed at circuit breakers for medium voltage DC (1-100kV, just below the transmission voltage range). Medium voltage DC is itself an interesting area, essentially DC for distribution.

- Creating Innovative and Reliable Circuits Using Inventive Topologies and Semiconductors (CIRCUITS), released in 2017, funded 22 projects.

Semiconductors are essential for making the existing grid work in a new way.

The selected projects range across application areas, including power conversion and power condition for grid applications. Semiconductors are going to be the backbone of the grid, whether it’s highly connected or increasingly balkanized. The types of power coming on line have different characteristics and grid effects than the power used for the last 100 years.

- The 2018 and 2021 OPEN solicitations and the ongoing Exploratory Topics program have also funded projects broadly related to the above categories, including high voltage circuit breakers and AI applications for national transmission planning and management.

MVDC lines could connect, for example, grid scale solar, storage and wind directly to loads. This is especially attractive for data centers right now, but the area could grow, especially if super conducting and undergrounding capabilities grow.

DC circuit breakers are a technical challenge compared to AC circuit breakers because DC power does not oscillate through zero many times per second. AC circuit breakers can stop the power when there’s no power to stop, so the force needed is minimal. DC circuit breakers have to actually interrupt the power, which requires a lot of force. Legacy DC systems were synced with AC systems so they could easily use an AC circuit breaker. The latest DC technology does not need the AC systems in the same way, which makes them more flexible to use but opens up the circuit breaker need. MVDC solutions could likely be stacked for high voltage applications areas, as well.

Other Hardware Areas of Interest

Modular transformers and converters are the building blocks of the grid; they are the components that turn low voltage into high voltage and vice versa. Converters are the components that turn AC to DC. Both of these essential components need a modular solution. Our grid is surprisingly bespoke — modular transformers and converters would enable a faster and cheaper expansion of capacity. Research in this area started decades ago, including at the Electric Power Research Institute (EPRI), on transformers but solutions have not taken off yet. Lack of compatibility between global grids is a possible barrier. Additionally, though fear of transformer shortages is always top of mind for utilities, until recently those fears were not realized. The pandemic created supply chain shortages, exacerbated by the market consolidation and off-shoring of the past decade. Transformers are in short supply, with high prices and long wait times. Recent substation attacks, both singular as in North Carolina and widespread as in Ukraine, highlight the critical need for more robust technical solutions.[40]

Conclusion

The decarbonization and democratization of the electricity sector are happening quickly, and the grid must adapt. Demand response and net metering are already changing business models; individual consumers can now be compensated for how their energy generation and use supports the distribution grid. Data is accumulating, as are distributed tech solutions, though standardization, aggregation, and actionability are still developing. Market dominance, open source approaches, or regulations on communications and data protocols will eventually lead to the consolidation of solutions and platforms.

Overall, the grid is a physically and technologically vast area, with a number of new technologies and operational pain points in an industry that does not like change, and has not faced transformative challenges. The US grid is at once highly connected but also quite isolated. The regulatory system is balkanized by geography (typically state boundaries) and also business models – with rural co-ops and investor owned utilities facing different landscapes. The electricity flow is isolated by one-way power management systems and 12 different grid planners (+ Hawaii and Alaska!) with limited connectivity between regions. As a result, though everyone sees the future coming where the grid operates differently, no one is in the driver’s seat.

There is a lot of startup activity at the grid edge and distribution, with even more needed as electrification increases. At the transmission scale, regulatory barriers are slowing adoption of new technologies and building of new infrastructure, but also creating opportunities for tech that can innovate on existing infrastructure rights-of-way. Consumer cost and land use concerns will be key issue areas that influence the direction of adoption – if the least-cost transmission-heavy path is followed, if undergrounding takes off, or if the scales weigh in favor of more local solutions. Regardless, the hardware and software needs are widespread.

We’re watching semiconductors and superconductors development, medium voltage application areas, and the policies at the grid edge and transmission system that will chart the path forward.

Landscape[41]

AutoGrid

Category: Distribution systems management

Differentiator: first mover in distribution data analysis and management, software focused initially on utilizing consumer storage assets

Year Founded: 2011

Country: USA

Last Financing: Acquired by Schneider Electric (PAR: SU) in May 2022

Camus Energy

Category: Distribution system management

Differentiator: Cloud-based, machine learning system for highly reliable and scalable distribution management system

Year Founded: 2019

Country: USA

Last Financing: Closed Series A $16M in June 2021

CTC Global

Category: Transmission Conductors

Differentiator: Manufacturer of composite core for lines that can carry more power safely

Year Founded: 2002

Country: USA

Last Financing: Venture investors sold their stakes for an undisclosed amount in February 2021

EarthGrid

Category: Transmission Conductors and enabling technology

Differentiator: Plasma boring machines for undergrounding and co-locating utility lines

Year Founded: 2016

Country: USA

Last Financing: Seed round for undisclosed amount in progress as of November 2022, aiming for February 2023 close

Envelio

Category: Distribution systems management

Differentiator: Highly accurate simulation of distribution system, integrating smart meter data and grid operator model

Year Founded: 2017

Country: Germany

Last Financing: Acquired by E.ON (ETR: EOAN) in December 2021

Fermata

Category: Grid Edge V2G

Differentiator: Bidirectional charger with vehicle-to-everything energy management system

Year Founded: 2010

Country: USA

Last Financing: $40M later stage VC in January 2022

LineVision

Category: Transmission hardware+

Differentiator: distributed sensors that detect microclimate to maximize use of lines

Year Founded: 2010

Country: USA

Last Financing: Closed a $33.13M Series C in October 2022

MetOx

Category: Transmission conductors

Differentiator: Manufacturer of superconducting wire

Year Founded: 1997

Country: USA

Last Financing: Undisclosed amount in February 2022, previously $28.14M Series A in January 2022

NewGrid

Category: Transmission analytics

Differentiator: maximizes power flow through topology changes

Year Founded:

Country: USA

Last Financing: $0.18M Angel round in May 2018

Nuvve (NAS: NVVE)

Category: Grid Edge V2G

Differentiator: Bidirectional charger to enable Vehicle-to-grid integration

Year Founded: 2010

Country: USA

Last Financing: Acquired Newborn Acquisition (NASDAQ: NBAC) through a reverse merger in March 22, 2021

OhmConnect

Category: Grid Edge VPP

Differentiator: Software system for Distributed Energy Resource Management (DERMS)

Year Founded: 2013

Country: Canada

Last Financing: Closed Series D $55M in June 2022

Opus One

Category: Distribution systems software

Differentiator: Software system for Distributed Energy Resource Management (DERMS)

Year Founded: 2011

Country: Canada

Last Financing: Acquired by General Electric (NYS: GE) for $70 million in December 2021

Pearl Street Technologies

Category: Transmission analytics

Differentiator: automates transmission planning to incorporate more renewable energy

Year Founded: 2017

Country: USA

Last Financing: $2.82M seed round in March 2022

Petra

Category: Transmission conductors

Differentiator: Clean energy technology designed to offer a smart streetlight network

Year Founded: 2013

Country: USA

Last Financing: $15 million Series A in June 2022

Recurve

Category: Distribution systems software

Differentiator: Open source software system that uses smart meter data to enable aggregation of behind-the-meter assets into virtual power plants

Year Founded: 2015

Country: USA

Last Financing: $19.03M seed round in March 2022

Renew Power Systems (RPSi)

Category: Grid Edge microgrids

Differentiator: Grid forming inverters and hardware agnostic software for OTT solutions

Year Founded: 2018

Country: USA

Last Financing: Grant from Minnesota Department of Employment and Economic Development

Smart Wires (STO: GOGRID)

Category: Transmission hardware+

Differentiator: modular semiconductor solutions to manage grid flow through changing line dynamics

Year Founded: 2010

Country: USA

Last Financing: IPO May 2021, $489.77M post

SwitchedSource

Category: Distribution system hardware+

Differentiator:

Year Founded: 2016

Country: USA

Last Financing: $8.56M grant from Arpa-E in January 2021

TSConductor

Category: Transmission conductors

Differentiator: Custom carbon core and aluminum encapsulation to maximize power transmission capabilities

Year Founded: 2018

Country: USA

Last Financing: Closed Series A1 $25M in November 2021

Varentec

Category: Distribution system software

Differentiator: Works with grid edge technologies to manage power flow of the distribution grid

Year Founded: 2008

Country: USA

Last Financing: Acquired by Koch Engineered Solutions in February 2021

VEIR

Category: Transmission conductors

Differentiator: Evaporative cooling for HTS capable of overhead and underground use

Year Founded: 2019

Country: USA

Last Financing: Completed $12M Series A in March 2021

WeaveGrid

Category: Grid Edge V2G

Differentiator: Electrification software designed to connect electric vehicles to the grid using predictive analytics

Year Founded:2018

Country: USA

Last Financing: Closed $35 million Series B in November 2022

Xendee

Category: Grid Edge microgrids

Differentiator: Tech agnostic microgrid decision support system for fast customer acquisition

Year Founded: 2018

Country: USA

Last Financing: Closed $12M Series A in June 2022

Acknowledgements

Thank you to the many people who shared their time and provided insight into this landscape analysis, especially:

Liz Stein

Henk Both, Anzu Partners

Ramez Naam

David Bromberg, PhD, Pearl Street Technologies

Pablo Ruiz, PhD, NewGrid

Julia Selker, Watt Coalition

Charles Murray, Switched Source

Astrid Atkinson, Camus Energy

Scott Tracy and Zach Emond, RPSi

Chelsea Sexton and David Nemtzow, Department of Energy

Tim Heidl, VEIR

Tim Singer, National Grid Partners

Troy Helming, EarthGrid

Giancarlo Savini, Future Energy Ventures

References

[1] American Association of Engineering Societies, National Academy Of Engineering Reveals Top Engineering Impacts of The 20th Century: Electrification Cited As Most Important, ScienceDaily, March 2000

[2] Larson, E., et al, Net-Zero America: Potential Pathways, Infrastructure, and Impacts, Interim Report, Princeton University, 2020

[3] Lew, Debra, et al, Transmission Planning for 100% Clean Electricity: Enabling Clean, Affordable, and Reliable Electricity, IEEE Power and Energy Magazine 19.6, 2021: 56-66

[4] Portions of this section replicate previously published work by the author: Reed, Liza, The Electric Grid Is the Bottleneck to Decarbonizing Energy by 2050, Prime Movers Lab Blog, November 2022

[5] Element Inventory, Transmission Availability Data System, North American Electric Reliability Corporation

[6] Jennifer Weeks, U.S. Electrical Grid Undergoes Massive Transition to Connect to Renewables, Scientific American, April 2010,

[7] Portions of this section replicate previously published work by the author: Reed, Liza, The Electric Grid Is the Bottleneck to Decarbonizing Energy by 2050, Prime Movers Lab Blog, November 2022

[8] Clack, C. et al, A Plan for Economy-Wide Decarbonization of the United States, Vibrant Clean Energy, 2021

[9] Larson, Net-Zero America

[10] Lew et al, Transmission Planning for 100% Clean Energy>

[11] Denholm, Paul, et al, Examining Supply-Side Options to Achieve 100% Clean Electricity by 2035, No. NREL/TP-6A40-81644, National Renewable Energy Lab (NREL), 2022

[12] Brown, Patrick R., and Audun Botterud, The value of inter-regional coordination and transmission in decarbonizing the US electricity system, Joule 5.1, 2021: 115-134

[13] Lawson, Ashley, Decarbonizing US power, Climate innovation 2050, 2018

[14] California, State of, As Record Heat Wave Intensifies, Governor Newsom Extends Emergency Response to Increase Energy Supplies and Reduce Demand, Office of Governor Gavin Newsom, September 2022

[15] Shreve, Dan, Deep Decarbonisation: The Multi-Trillion Dollar Question, Wood Mackenzie, June 2019

[16] Peskoe, Ari, Is the Utility Transmission Syndicate Forever?, Energy LJ 42, 2021: 1

[17] US EIA, Investor-Owned Utilities Served 72% of U.S. Electricity Customers in 2017, EIA: Today In Energy, UE Energy Information Administration, August 2019

[18] Peskoe, Ari, Is the Utility Transmission Syndicate Forever?, Energy LJ 42, 2021: 1

[19] Reed, Liza, Clean Energy Needs More Electricity Transmission Lines, OurEnergyPolicy, November 2022

[20] Portions of this section replicate previously published work by the author: Reed, Liza, The Electric Grid Is the Bottleneck to Decarbonizing Energy by 2050, Prime Movers Lab Blog, November 2022

[21] List of Voltages & Frequencies (Hz) by Country - Electric Power around the Globe, Generator Source

[22] Fischetti, Mark, Japan's Two Incompatible Power Grids Make Disaster Recovery Harder, Observations, Scientific American, March 2011

[23] Agarwal, Tarun, What Is Transformer Winding : Types & Its Applications, ElProCus, December 2021

[24] The War of the Currents: AC vs DC Power, xxx, Energy.gov, US Department of Energy, Novemver 2014

[25] NERC, Element Inventory

[26] Moglestue, Andreas, 60 years of HVDC: ABB’s road from pioneer to market leader, ABB Review 2, 2014: 32-41

[27] Reed, Liza and Xu, Andrew, FERC is coalescing around the idea of minimum transfer capacity but needs data and definitions, Niskanen Center, November 2022

[28] American Council on Renewable Energy, Macrogrid Initiative

[29] Lew, Transmission Planning for 100% Clean Energy

[30] St. John, Jeff, How Transmission along Railroads and Highways Could Break Open Clean..., Canary Media, April 2021

[31] Naam, Ramez, HVDC Lines in the US and China

[32] GE Grid Solutions and LineVision Partner to Deliver Comprehensive Dynamic System Rating Platform, LineVision, December 2022

[33] The Total Solution Conductor for Energy Transmission, TS Conductor, September 2021

[34] HTS Wire - Detail, MetOx Technologies

[35] Jhawar, Puneet Singh, What Are Distributed Energy Resources and How Do They Work?, Cummins

[36] How to Get Started with California Market Access: Earn Money This Summer through Peak Shifting and Saving Energy, ReCurve Blog, January 2022

[37] Loten, Angus, Schneider Electric-Backed Venture Firm to Launch $520 Million Fund, The Wall Street Journal, November 2022

[38] The US Department of Energy Loan Program Office series on Virtual Power Plants is an excellent resource for learning more about this developing area

[39] Individual Projects, ARPA-E

[40] Cavert, Johan, Electricity Transformer Funding: A Wonky but Necessary Solution to a Critical Resilience Problem, The Hill, December 2022

[41] Data gathered from PitchBook